Mathematics, 01.07.2020 17:01, Christiancameron1234

Kana is a single wage earner with no dependents and taxable income of $205,000 in 2018. Her 2017 taxable income was $155,000 and tax liability was $36,382. Calculate Kana's 2018 income tax liability and the minimum required 2018 annual payment necessary to avoid any penalty. Round your answers to two decimal places.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:40, kiingbr335yoqzaxs

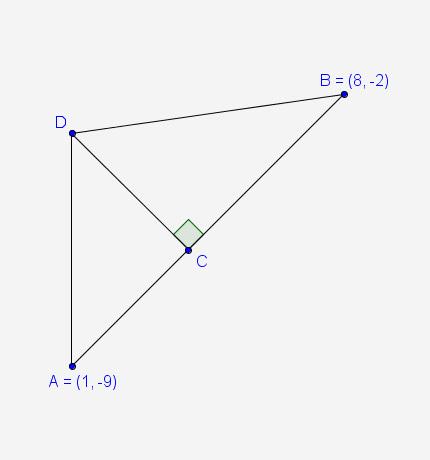

Given abcd ac=38 and ae=3x+4 find the value of x

Answers: 2

Mathematics, 21.06.2019 17:40, JordanJones04402

Given f(x)= 9x+1 and g(x)=x^3, choose the expression (f*g)(x)

Answers: 2

Mathematics, 21.06.2019 18:30, jeffreyaxtell4542

10% of 1,900,000. show me how you got the answer

Answers: 2

Do you know the correct answer?

Kana is a single wage earner with no dependents and taxable income of $205,000 in 2018. Her 2017 tax...

Questions in other subjects:

Mathematics, 08.05.2020 04:57

Mathematics, 08.05.2020 04:57

Biology, 08.05.2020 04:57

Mathematics, 08.05.2020 04:57