Business, 03.06.2021 01:20, nosleepbrooklyn2006

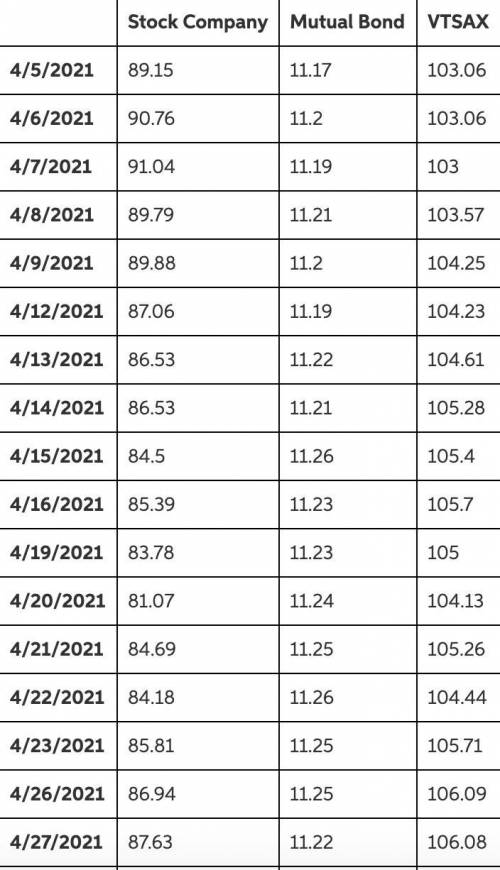

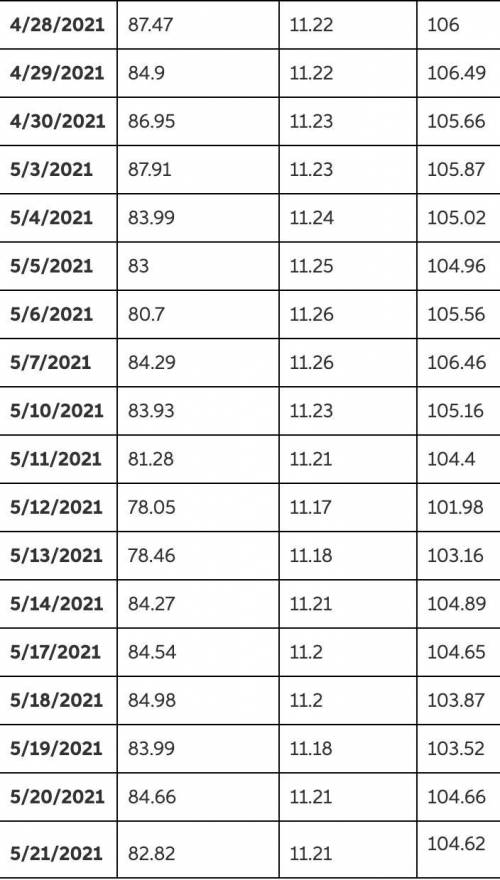

Data is in screenshots attached.

Please solve in Excel and show/explain calculations. Thank you!

The daily returns of these three assets.

The average return and standard deviation for these three assets.

The correlations between these three assets.

What is the future value for each of these assets at the end of the day on May 21st if you had $100 invested in each asset on April 5th?

What is the FV and daily returns of a portfolio that placed 70% in VTSAX and 30% in your bond mutual fund. What is the average return and standard deviation of this portfolio?

What is the FV and daily returns of a portfolio that placed 70% in your stock and 30% in your bond mutual fund. What is the average return and standard deviation of this portfolio?

What is the beta of your stock and the bond fund? Use the VTSAX as your proxy for the market.

What is the expected return on the stock for the company you are following? Use reasonable estimates of the variables that enter the CAPM.

What is the WACC for the company you chose to follow?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:00, jilliand2030

Why are the four primary service outputs of spatial convenience, lot size, waiting time, and product variety important to logistics management? provide examples of competing firms that differ in the level of each service output provided to customers?

Answers: 1

Business, 22.06.2019 16:00, hany90

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 17:30, tysisson9612

You should do all of the following before a job interview except

Answers: 2

Do you know the correct answer?

Data is in screenshots attached.

Please solve in Excel and show/explain calculations. Thank you!

Questions in other subjects:

Social Studies, 02.10.2019 13:10

History, 02.10.2019 13:10