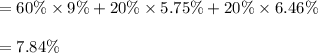

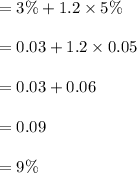

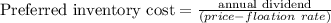

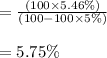

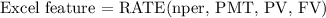

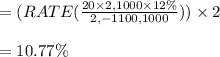

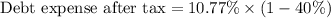

Preston Corp. is estimating its WACC. Its target capital structure is 20 percent debt, 20 percent preferred stock, and 60 percent common equity. Its bonds have a 12 percent coupon, paid semiannually, a current maturity of 20 years, and sells for $1,100. The firm could sell, at par, $100 preferred stock which pays a 5.52 percent annual dividend, but flotation costs of 5 percent would be incurred. Preston's beta is 1.2, the risk-free rate is 3 percent, and the market risk premium is 5 percent. The firm's marginal tax rate is 40 percent. What is Preston's WACC

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:00, skgoldsmith

Symantec corp., located in cupertino, california, is one of the world's largest producers of security and systems management software. the company's consolidated balance sheets for the 2009 and 2008 fiscal years included the following ($ in thousands): current assets: receivables, less allowances of $21,766 in 2009 and $24,089 in 2008 $ 838,010 $ 758,700 a disclosure note accompanying the financial statements reported the following ($ in thousands): year ended 2009 2008 (in thousands) trade accounts receivable, net: receivables $ 859,776 $ 782,789 less: allowance for doubtful accounts (8,938) (8,990) less: reserve for product returns (12,828) (15,099) trade accounts receivable, net: $ 838,010 $ 758,700 assume that the company reported bad debt expense in 2009 of $2,000 and had products returned for credit totaling $3,230 (sales price). net sales for 2009 were $6,174,800 (all numbers in thousands).required: what is the amount of accounts receivable due from customers at the end of 2009 and 2008? what amount of accounts receivable did symentec write off during 2009? what is the amount of symentec’s gross sales for the 2009 fiscal year? assuming that all sales are made on a credit basis, what is the amount of cash symentec collected from customers during the 2009 fiscal year?

Answers: 3

Business, 21.06.2019 21:00, marie1211

John novosel was employed by nationwide insurance company for fifteen years. novosel had been a model employee and, at the time of discharge, was a district claims manager and a candidate for the position of division claims manager. during novosel's fifteenth year of employment, nationwide circulated a memorandum requesting the participation of all employees in an effort to lobby the pennsylvania state legislature for the passage of a certain bill before the body. novosel, who had privately indicated his disagreement with nationwide's political views, refused to lend his support to the lobby, and his employment with nationwide was terminated. novosel brought two separate claims against nationwide, arguing, first, that his discharge for refusing to lobby the state legislature on behalf of nationwide constituted the tort of wrongful discharge in that it was arbitrary, malicious, and contrary to public policy. novosel also contended that nationwide breached an implied contract guaranteeing continued employment so long as his job performance was satisfactory. what decision as to each claim?

Answers: 3

Business, 21.06.2019 21:50, samchix727

You have $22,000 to invest in a stock portfolio. your choices are stock x with an expected return of 11 percent and stock y with an expected return of 13 percent. if your goal is to create a portfolio with an expected return of 11.74 percent, how much money will you invest in stock x? in stock y?

Answers: 2

Business, 22.06.2019 03:00, rafa3997

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Do you know the correct answer?

Preston Corp. is estimating its WACC. Its target capital structure is 20 percent debt, 20 percent pr...

Questions in other subjects:

History, 22.01.2020 19:31

English, 22.01.2020 19:31

Mathematics, 22.01.2020 19:31

History, 22.01.2020 19:31

Chemistry, 22.01.2020 19:31

Capital equity costs+cost of common stock

Capital equity costs+cost of common stock