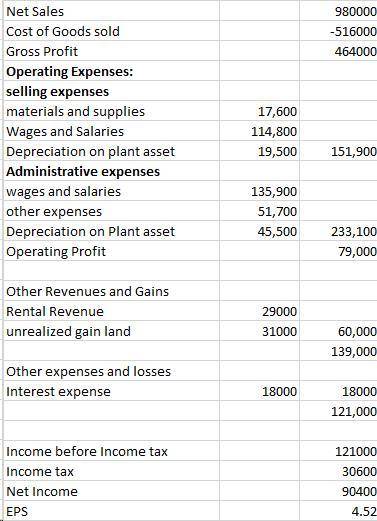

The accountant of Weatherspoon Shoe Co. has compiled the following information from the company's records as a basis for an income statement for the year ended December 31, 2010.

Rental revenue $29,000

Interest expense 18,000

Market appreciation on land above cost 31,000

Wages and salaries-sales 114,800

Materials and supplies-sales 17,600

Income tax 30,600

Wages and salaries-administrative 135,900

Other administrative expenses 51,700

Cost of goods sold 516,000

Net sales 980,000

Depreciation on plant assets (70% selling, 30% administrative) 65,000

Dividends declared 16,000

There were 20,000 shares of common stock outstanding during the year.

(a) Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, e. g. 5.25. For multiple entries list from largest to smallest amounts, e. g. 10, 5, 1. Enter all amounts as positive amounts and subtract where necessary.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, saltyclamp

Max fischer is a beekeeper. his annual group insurance costs 11,700. his employer pays 60% of the cost. how much does max pay semimonthly for it?

Answers: 1

Business, 22.06.2019 03:10, samantha636

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 06:40, lexhorton2002

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

Do you know the correct answer?

The accountant of Weatherspoon Shoe Co. has compiled the following information from the company's re...

Questions in other subjects:

Mathematics, 02.07.2019 13:30

Computers and Technology, 02.07.2019 13:30

English, 02.07.2019 13:30

Mathematics, 02.07.2019 13:30

Mathematics, 02.07.2019 13:30