Business, 11.03.2020 18:12, heebi4jeebi

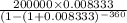

Amortizing loans Suppose that you take out a 30-year mortgage loan of $200,000 at an interest rate of 10%. a. b. c. A)What is your total monthly payment? B)How much of the first month’s payment goes to reduce the size of the loan? C)How much of the payment after two years goes to reduce the size of the loan?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 05:20, naomicervero

Social computing forces companies to deal with customers as opposed to

Answers: 2

Business, 22.06.2019 12:40, payshencec21

Alarge tank is filled to capacity with 500 gallons of pure water. brine containing 2 pounds of salt per gallon is pumped into the tank at a rate of 5 gal/min. the well-mixed solution is pumped out at the same rate. find the number a(t) of pounds of salt in the tank at time t.

Answers: 3

Business, 22.06.2019 13:00, dolltan

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

Business, 22.06.2019 15:20, sgalvis455

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

Do you know the correct answer?

Amortizing loans Suppose that you take out a 30-year mortgage loan of $200,000 at an interest rate o...

Questions in other subjects:

Mathematics, 06.11.2019 20:31

Mathematics, 06.11.2019 20:31

History, 06.11.2019 20:31

................1

................1