Business, 21.12.2019 03:31, DaiDai8328

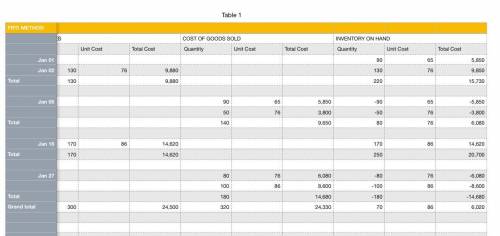

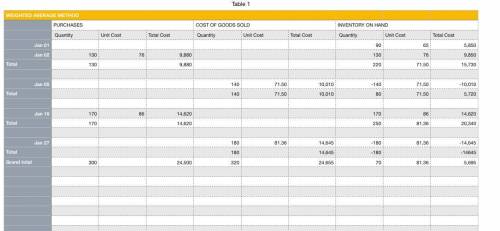

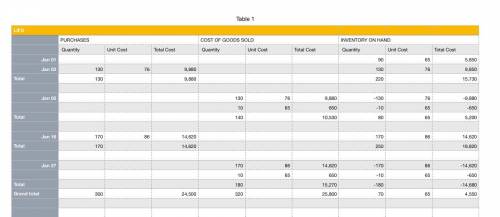

Fit world began january with merchandise inventory of 90 crates of vitamins that cost a total of $ 5,850. during the month, fit world purchased and sold merchandise on account as follows: jan 2 purchases 130 crates @ 76 eachjan 5 sale 140 crates @ 100 eachjan 16 purchases 170 crates @ 86 eachjan 27 sale 180 crates @ 104eachrequirement 1. prepare a perpetual inventory record, using the fifo inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. begin by computing the cost of goods sold and cost of ending merchandise inventory using the fifo inventory costing method. enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventorypurchased, sold, and on hand at the end of the period. (enter the oldest inventory layers first.)purchasescost of goods soldinventory on . 1251627totalsgross profit is $ using the fifo inventory costing method. requirement 2. prepare a perpetual inventory record, using the lifo inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. begin by computing the cost of goods sold and cost of ending merchandise inventory using the lifo inventory costing method. enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventorypurchased, sold, and on hand at the end of the period. (enter the oldest inventory layers first.)purchasescost of goods soldinventory on . 1251627totalsgross profit is $ the lifo inventory costing method. requirement 3. prepare a perpetual inventory record, using theweighted-average inventory costing method, and determine thecompany's cost of goods sold, ending merchandise inventory, and gross profit. begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventorypurchased, sold, and on hand at the end of the period. (round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.)purchasescost of goods soldinventory on . 1251627totalsgross profit is $ the weighted-average inventory costing method. requirement 4. if the business wanted to pay the least amount of income taxes possible, which method would it choose? if the business wanted to pay the least amount of income taxespossible, they would choose (select correct answer; fifo, lifo or weighted-average).

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, legrandschool1oxa0sd

The following information relates to wagner, inc.: advertising costs $ 18 comma 600 administrative salaries 17 comma 800 delivery vehicle depreciation 1 comma 500 factory repair and maintenance 600 indirect labor 10 comma 000 indirect materials 18 comma 000 manufacturing equipment depreciation 3 comma 000 office rent 58 comma 000 president's salary 1 comma 100 sales revenue 600 comma 000 sales salary 5 comma 200 how much were wagner's period costs

Answers: 3

Business, 22.06.2019 11:20, jaideeplalli302

You decided to charge $100 for your new computer game, but people are not buying it. what could you do to encourage people to buy your game?

Answers: 1

Business, 22.06.2019 19:40, jair512872

Lauer corporation uses the periodic inventory system and has provided the following information about one of its laptop computers: date transaction number of units cost per unit 1/1 beginning inventory 210 $ 910 5/5 purchase 310 $ 1,010 8/10 purchase 410 $ 1,110 10/15 purchase 255 $ 1,160 during the year, lauer sold 1,025 laptop computers. what was cost of goods sold using the lifo cost flow assumption?

Answers: 1

Business, 22.06.2019 22:00, lizdeleon248

Your sister turned 35 today, and she is planning to save $60,000 per year for retirement, with the first deposit to be made one year from today. she will invest in a mutual fund that's expected to provide a return of 7.5% per year. she plans to retire 30 years from today, when she turns 65, and she expects to live for 25 years after retirement, to age 90. under these assumptions, how much can she spend each year after she retires? her first withdrawal will be made at the end of her first retirement year.

Answers: 3

Do you know the correct answer?

Fit world began january with merchandise inventory of 90 crates of vitamins that cost a total of $ 5...

Questions in other subjects:

English, 13.10.2020 03:01

Mathematics, 13.10.2020 03:01