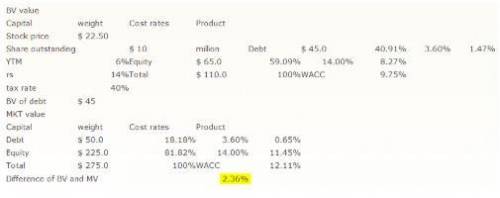

Sapp trucking’s balance sheet shows a total of noncallable $45 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. this debt currently has a market value of $50 million. the balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. the current stock price is $22.50 per share; stockholders' required return, rs, is 14.00%; and the firm's tax rate is 40%. what is the wacc of the firm based on the market values of debt and equity?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 21:40, summerhumphries3

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Business, 23.06.2019 01:30, zayeboyd4436

Brian has just finished college. he wants to set up a small business to make and sell fireworks. he registers his company and acquires a license from the government. he finds that most of his competitors are selling fireworks at an extremely low price. he would like to make more money, so he decides to innovate and develop better fireworks. he sells his fireworks at a higher price, and they are a huge hit with the customers. after a few years, he earns enough profit to set up a bigger fireworks factory that complies with the government’s health and safety regulations. he even starts exporting fireworks overseas. which type of economy does this scenario describe?

Answers: 3

Business, 23.06.2019 02:20, mpgleboski

When the benefit of one particular use of a resource is greater than the opportunity cost, then that resource is which of the following? a. not scarce b. being used efficiently c. a normal good d. non-excludable

Answers: 2

Business, 23.06.2019 10:40, 19sierraamber

The mccolls have made an offer on a new home. the home is new construction and scheduled to be completed by the end of the year. they provide a purchase deposit--a check in the amount of $40,000--to their agent, suzette. suzette, at the broker's direction, deposits the earnest money in the broker's trust fund account within two business days of receipt of the funds. did suzette follow the proper procedures? a. no, the check should not have been cashed. if a check is used as an earnest money deposit, it is to be held until acceptance of the offer. the seller must also be informed the buyer's check is being held and not negotiated. b. yes, suzette deposited the earnest money in the broker's trust fund account as directed. she also deposited the check within three business days of receipt. unless there were written instructions to hold the check until acceptance of the offer, the check may be cashed. c. no, suzette needed to deposit the earnest money in the broker's trust fund account within two days of receipt, not necessarily two business days. d. both a and c

Answers: 2

Do you know the correct answer?

Sapp trucking’s balance sheet shows a total of noncallable $45 million long-term debt with a coupon...

Questions in other subjects:

Mathematics, 20.11.2020 03:50

Spanish, 20.11.2020 03:50

Biology, 20.11.2020 03:50

Mathematics, 20.11.2020 03:50

Mathematics, 20.11.2020 03:50