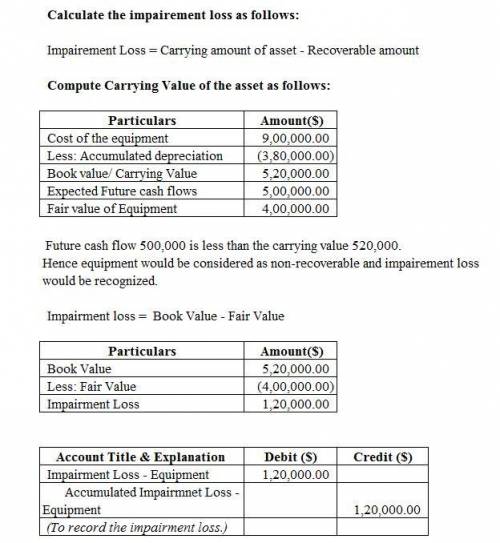

Jurassic company owns equipment that cost $900,000 and has accumulated depreciation of $380,000. the expected future net cash flows from the use of the asset are expected to be $500,000. the fair value of the equipment is $400,000. prepare the journal entry, if any, to record the impairment loss.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 17:20, dixks

The following extract was taken from the worksheet of special events bakers for the year 2019. special events bakers worksheet december 31, 2019 account names cash equipment accumulated depreciation minus− equipment unadjusted trial balance debit credit $ 6 comma 800$6,800 15 comma 20015,200 $ 8 comma 500$8,500 adjusted trial balance debit credit $ 6 comma 800$6,800 15 comma 20015,200 $ 10 comma 000$10,000 for the above information, determine the amount of depreciation expense for the equipment used in the business

Answers: 3

Business, 22.06.2019 09:00, tiffanibell71

Asap describe three different expenses associated with restaurants. choose one of these expenses, and discuss how a manager could handle this expense.

Answers: 1

Business, 22.06.2019 20:20, abbz13

Which statement is not true about a peptide bond? which statement is not true about a peptide bond? the peptide bond has partial double-bond character. the carbonyl oxygen and the amide hydrogen are most often in a trans configuration with respect to one another. rotation is restricted about the peptide bond. the peptide bond is longer than the typical carbon-nitrogen bond.

Answers: 2

Do you know the correct answer?

Jurassic company owns equipment that cost $900,000 and has accumulated depreciation of $380,000. the...

Questions in other subjects:

Mathematics, 25.05.2021 14:20

Mathematics, 25.05.2021 14:20

Mathematics, 25.05.2021 14:20

Mathematics, 25.05.2021 14:20

Mathematics, 25.05.2021 14:20

Mathematics, 25.05.2021 14:20