Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company�s discount rate is 17%. after careful study, oakmont estimated the following costs and revenues for the new product:

cost of equipment needed $ 275,000

working capital needed $ 86,000

overhaul of the equipment in two years $ 10,000

salvage value of the equipment in four years $ 13,000

annual revenues and costs:

sales revenues $ 420,000

variable expenses $ 205,000

fixed out-of-pocket operating costs $ 87,000

when the project concludes in four years the working capital will be released for investment elsewhere within the company.

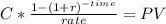

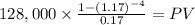

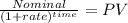

calculate the net present value of this investment opportunity.

Answers: 2

Similar questions

Business, 22.06.2019 04:10, jennifer9983

Answers: 2

Business, 25.06.2019 08:00, daniellecraig77

Answers: 2

Business, 14.07.2019 15:30, Katy3613

Answers: 1

Business, 05.11.2019 06:31, AmityHeart

Answers: 3

Do you know the correct answer?

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the...

Questions in other subjects:

Computers and Technology, 16.09.2021 23:00

Social Studies, 16.09.2021 23:00

Mathematics, 16.09.2021 23:00

History, 16.09.2021 23:00

Mathematics, 16.09.2021 23:00

Physics, 16.09.2021 23:00

History, 16.09.2021 23:00