Social Studies, 07.07.2019 05:30, babygirl091502

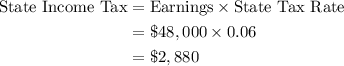

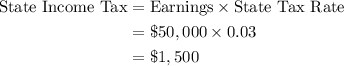

Jamal is a nurse and earns $48,000 per year. he lives in california and pays about 6 percent of his income in state income taxes. his sales tax rate is 8 percent. diamond is an accountant and earns $50,000 per year. she lives in arizona and pays about 3 percent of her income in state income taxes. her sales tax rate is 9.5 percent. jamal and diamond are calculating their taxes for the year. they both have no dependents, so their federal tax rates are the same. who would pay more in federal income taxes? who would pay more in sales taxes when making purchases?

Answers: 1

Other questions on the subject: Social Studies

Do you know the correct answer?

Jamal is a nurse and earns $48,000 per year. he lives in california and pays about 6 percent of his...

Questions in other subjects:

Mathematics, 27.07.2019 09:30

Social Studies, 27.07.2019 09:30

History, 27.07.2019 09:30