Mathematics, 23.07.2019 05:00, kennyg02

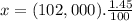

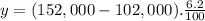

In 2009, the maximum taxable income for social security was $102,000 and the rate was 6.2%. the rate for medicare tax was 1.45%. if jessica's taxable income was $152,000 that year, how much did she pay in fica taxes?

Answers: 1

Similar questions

Mathematics, 30.06.2019 06:00, pinkmoonlight

Answers: 1

Mathematics, 26.08.2019 09:00, gael6529

Answers: 2

Mathematics, 21.10.2019 20:00, 21schraderlily

Answers: 2

Do you know the correct answer?

In 2009, the maximum taxable income for social security was $102,000 and the rate was 6.2%. the rate...

Questions in other subjects:

Social Studies, 07.10.2021 16:00

Mathematics, 07.10.2021 16:00

Physics, 07.10.2021 16:00

Mathematics, 07.10.2021 16:00

English, 07.10.2021 16:00

SAT, 07.10.2021 16:00