Mathematics, 06.11.2019 10:31, cgarnett5408

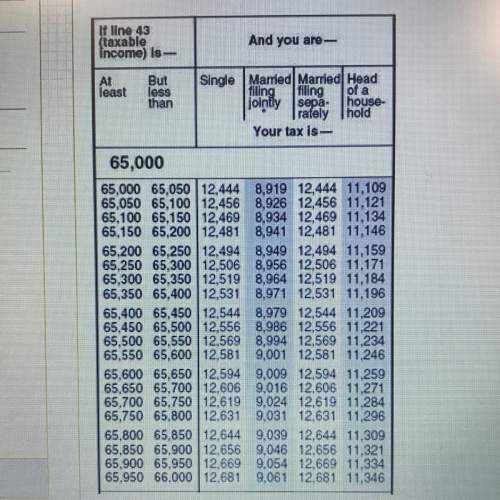

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does he have to pay if he files with the “single” status? a.) $9,024 b.) $9,031 c.) $12,631 d.) $12,619

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:30, sydthekid9044

Divide the following fractions 3/4 ÷ 2/3 1/2 8/9 9/8 2

Answers: 2

Mathematics, 21.06.2019 18:20, Gigglygoose4181

Choose all that apply. select all of the fees a credit card may have. annual fee apr balance transfer fee cash advance fee late fee overdraft fee over-the-limit fee

Answers: 2

Mathematics, 21.06.2019 19:30, youcandoit13

Click the arrows to advance or review slides. mapping carbohydrates to food carbohydrates (grams) 15 food (quantity) bread (1 slice) pasta (1/3 cup) apple (1 medium) mashed potatoes (1/2 cup) broccoli (1/2 cup) carrots (1/2 cup) milk (1 cup) yogurt (6 oz.) 12 12 is jennifer's relation a function? yes no f 1 of 2 → jennifer figure out the difference between a function and a relation by answering the questions about her food choices

Answers: 2

Do you know the correct answer?

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does...

Questions in other subjects:

Physics, 19.03.2020 18:44