Mathematics, 17.01.2022 14:00, christopher766

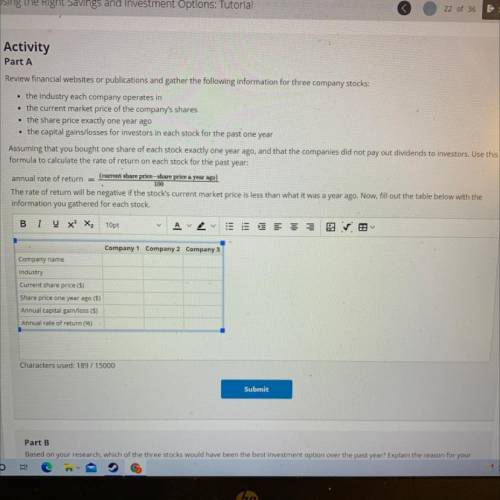

Review financial websites or publications and gather the following information for three company stocks:

• the industry each company operates in

• the current market price of the company's shares

• the share price exactly one year ago

• the capital gains/losses for investors in each stock for the past one year

Assuming that you bought one share of each stock exactly one year ago, and that the companies did not pay out dividends to investors. Use this

formula to calculate the rate of return on each stock for the past year:

annual rate of return = (current share price-share price a year ago)

100

The rate of return will be negative if the stock's current market price is less than what it was a year ago. Now, fill out the table below with the

information you gathered for each stock.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:00, guccim5971

Suppose you are an avid reader and are looking to save money on the cost of books instead of paying about $20 for each book, you decide to look into purchasing a kindle for $120 you can purchase e-books for about $5 each 1. find the slope-intercept equation for the cost of the hard copy of books using x to represent the number of books 2. find the slope-intercept equation for the cost of the kindle with cost of e-books using x to represent the number of books

Answers: 1

Mathematics, 21.06.2019 22:00, lraesingleton

What is the solution to the division problem below x3+x2-11x+4/x+4

Answers: 2

Mathematics, 22.06.2019 04:30, goodygoodgirlygirl

Me. brady is putting trim around the edge of circular merry-go-round that has diameter of 15 feet. how much trim does he need to buy to the nearest tenth

Answers: 1

Do you know the correct answer?

Review financial websites or publications and gather the following information for three company sto...

Questions in other subjects:

Mathematics, 11.12.2019 02:31

English, 11.12.2019 02:31

Chemistry, 11.12.2019 02:31

History, 11.12.2019 02:31