Mathematics, 15.12.2021 01:50, destinycasillas

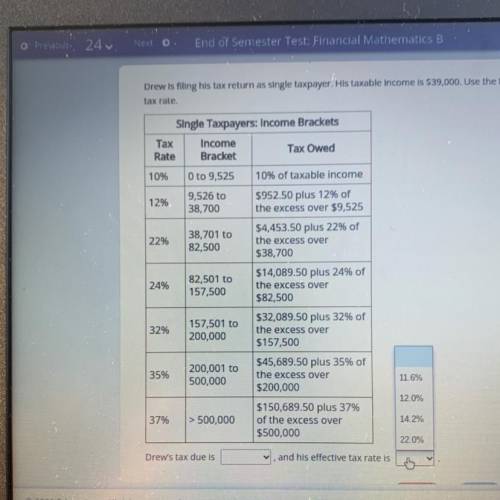

Drew is filling his tax return as single taxplayer. His taxable income is 39,000. Use the tax table provided to compute Drew’s tax due and effective tax Rate. Drew’s tax due is <4,519.50 or 4,680.00 or 5,525.25 or 8,580.00>, and his effective tax rate is <11.6% or 12.0% or 14.2% or 22.0%>

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 19:00, munozgiselle

If (x-2) 2= 49, then x could be a. -9 b. -7 c.- 2 d. 5 e.9

Answers: 2

Mathematics, 22.06.2019 00:30, bobby237065

Three friends are comparing the prices of various packages of golf balls at a sporting goods store. hector finds a package of 6 golf balls that costs $4.50.

Answers: 3

Mathematics, 22.06.2019 07:30, gcarter1203

Determine the equation for the given line in slope-intercept form y=- r-1 y = 5x + 1 y=-3x-1 hint

Answers: 1

Do you know the correct answer?

Drew is filling his tax return as single taxplayer. His taxable income is 39,000. Use the tax table...

Questions in other subjects:

Biology, 21.10.2020 01:01

English, 21.10.2020 01:01

English, 21.10.2020 01:01

Mathematics, 21.10.2020 01:01

Arts, 21.10.2020 01:01

Mathematics, 21.10.2020 01:01