Mathematics, 23.10.2021 14:00, fahad7007

The bond has a coupon rate of 6.4%, pays interest annually, has a face value of £1,000 4 years to maturity, and a yield to maturity of 7.2% . you expect that interest rates will rise by 80 basis later today.

a.) calculate the initial price of bond and the modified duration of bond.

b.) use the modified duration to find the approximate percentage change in the bond's price and the new price of the bond.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:50, nelyanariba981p555ve

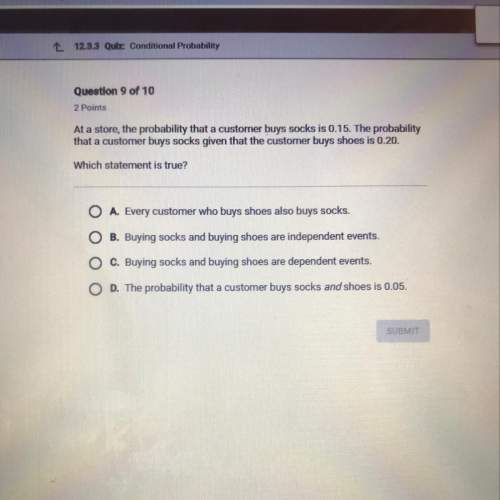

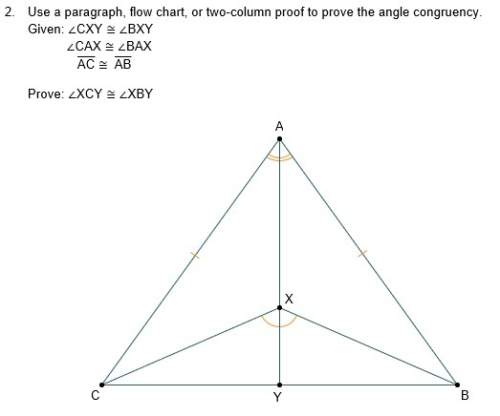

If m 17 27 90 63 ** picture is attached

Answers: 1

Mathematics, 21.06.2019 18:00, SunsetPrincess

Solve this equation using substitution. {4x + y = −2} {4x + 6y = 44}

Answers: 1

Mathematics, 21.06.2019 20:40, jaydenrobinettewca

Ineed someone to me answer my question i have to have this done and knocked out

Answers: 2

Do you know the correct answer?

The bond has a coupon rate of 6.4%, pays interest annually, has a face value of £1,000 4 years to ma...

Questions in other subjects:

Chemistry, 26.02.2021 02:30

History, 26.02.2021 02:30

Mathematics, 26.02.2021 02:30

Health, 26.02.2021 02:30

Chemistry, 26.02.2021 02:30