Mathematics, 20.10.2021 01:00, ira51

Purple Company has $200,000 in net income for 2019 before deducting any compensation or other payment to its sole owner, Kirsten. Kirsten is single, and she claims the $12,200 standard deduction for 2019. Purple Company is Kirsten’s only source of income. Ignoring any employment tax considerations, compute Kirsten’s after-tax income if:

a. Purple Company is a proprietorship and Kirsten withdraws $50,000 from the business during the year; Kirsten claims a $37,560 deduction for qualified business income.

b. Purple Company is a C corporation and the corporation pays out all of its after tax income as a dividend to Kirsten.

c. Purple Company is a C corporation and the corporation pays Kirsten a salary of $158,000.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:00, milagrosee12

Me, the vertices of quadrilateral coat are c(2,0), o(7,0), a(7,2) and t(2,2). prove that coat is a rectangle.

Answers: 3

Mathematics, 21.06.2019 19:30, maribelarreolap4sgpj

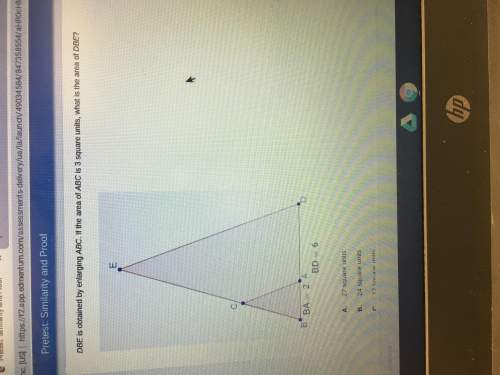

Two corresponding sides of two similar triangles are 3cm and 5cm. the area of the first triangle is 12cm^2. what is the area of the second triangle?

Answers: 1

Mathematics, 22.06.2019 01:00, ramireztony741

Michael split a rope that was 28 inches long into 5 equal parts. brenden split a rope that was 30 inches long into 6 equal parts. which boy's rope was cut into longer pieces?

Answers: 1

Do you know the correct answer?

Purple Company has $200,000 in net income for 2019 before deducting any compensation or other paymen...

Questions in other subjects:

Mathematics, 06.12.2021 01:00

Mathematics, 06.12.2021 01:00

Physics, 06.12.2021 01:00