Mathematics, 01.08.2021 14:00, angie249

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share forever.

b) Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% a year forever.

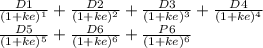

c) Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% a year for five years (i. e., until year 6) and zero thereafter. If the market capitalization rate for each stock is 10%, which stock is the most valuable? What if the capitalization rate is 7%?

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:50, michelerin9486

Which best describes the strength of the correlation, and what is true about the causation between the variables? it is a weak negative correlation, and it is not likely causal. it is a weak negative correlation, and it is likely causal. it is a strong negative correlation, and it is not likely causal. it is a strong negative correlation, and it is likely causal.

Answers: 1

Mathematics, 22.06.2019 01:10, mawawakaiii

Write each improper fraction as a mixed number. 9/4. 8/3. 23/6. 11/2. 17/5. 15/8. 33/10. 29/12.

Answers: 2

Do you know the correct answer?

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share fo...

Questions in other subjects:

Computers and Technology, 13.01.2021 15:20

Mathematics, 13.01.2021 15:20

Mathematics, 13.01.2021 15:20