Mathematics, 03.06.2021 06:10, yusufamin876

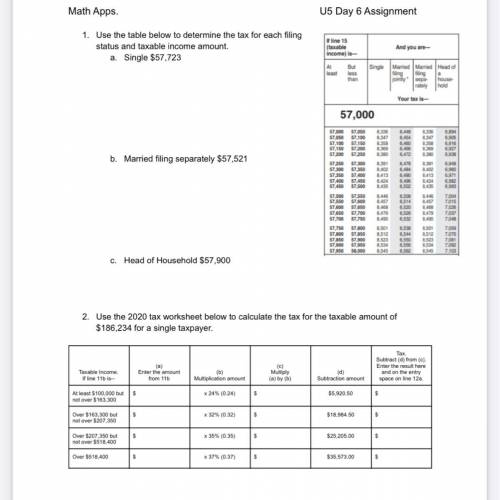

1. Use the table below to determine the tax for each filing status and taxable income amount.

a. Single $57,723

U5 Day 6 Assignment

b. Married filing separately $57,521

c. Head of Household $57,900

2. Use the 2020 tax worksheet below to calculate the tax for the taxable amount of $186,234 for a single taxpayer.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:02, denzel6887

Plz answer asap plz which is a solution to the equation 4b2 − 11b = 28 + 5b2? a) −5 b) −4 c) −3 d) 4

Answers: 1

Mathematics, 21.06.2019 20:00, aaliyahvelasauez

Last one and the bottom answer choice is y=(x-4)^2+1 you guys!

Answers: 1

Do you know the correct answer?

1. Use the table below to determine the tax for each filing status and taxable income amount.

a. Si...

Questions in other subjects:

Mathematics, 01.07.2020 22:01

Mathematics, 01.07.2020 22:01

History, 01.07.2020 22:01

Geography, 01.07.2020 22:01

Mathematics, 01.07.2020 22:01

English, 01.07.2020 22:01

Mathematics, 01.07.2020 22:01