Mathematics, 24.04.2021 23:20, deasia45

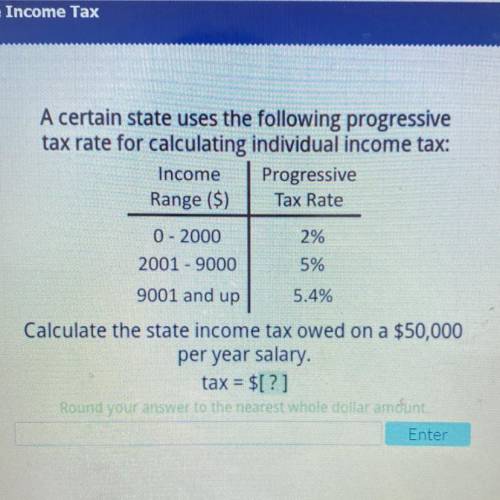

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up 5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:10, sawyerharper

Which expression do you get when you eliminate the negative exponents of 4a^2 b^216a^-3 b

Answers: 3

Mathematics, 21.06.2019 22:50, kaylarojascliff

On the first of each month sasha runs a 5k race she keeps track of her times to track her progress her time in minutes is recorded in the table

Answers: 1

Do you know the correct answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions in other subjects:

Social Studies, 14.01.2021 02:50

Arts, 14.01.2021 02:50

Arts, 14.01.2021 02:50

Arts, 14.01.2021 02:50

Arts, 14.01.2021 02:50