Mathematics, 24.04.2021 05:20, fayth8312

Jack had $12,100 in medical expenses. His insurance covered 80% of the expenses. The IRS allows deductions of medical and dental expenses of any amount exceeding 7.5% of the adjusted taxpayer’s gross income. If Jack’s adjusted gross income last year was $30,050.00, how much is Jack allowed to deduct?

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:00, marisolrojo2002

Which expression is equivalent to -5(3x - 6/7)

Answers: 1

Mathematics, 21.06.2019 23:00, erbnichole

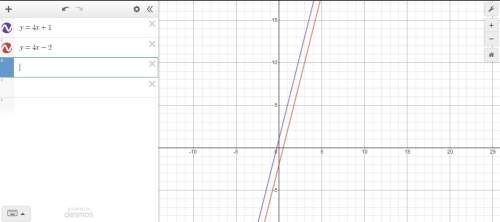

Graph the system of equations on your graph paper to answer the question. {y=−x+4y=x−2 what is the solution for the system of equations? enter your answer in the boxes.

Answers: 1

Mathematics, 22.06.2019 00:30, anitadefrances

What is the perimeter of an equilateral triangle if each side is (x+3)?

Answers: 1

Mathematics, 22.06.2019 01:50, claupatri120

Order the equations from least to greatest based on the number of solutions to each equation.-4^x -1 = 3^(-x) – 2 -3x + 6 = 2^x+13^x – 3 = 2x - 2

Answers: 1

Do you know the correct answer?

Jack had $12,100 in medical expenses. His insurance covered 80% of the expenses. The IRS allows dedu...

Questions in other subjects:

Mathematics, 02.10.2020 16:01

Mathematics, 02.10.2020 16:01

Mathematics, 02.10.2020 16:01