Mathematics, 26.08.2019 23:00, evazquez

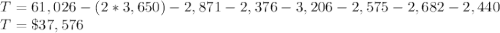

Say you are filing as a single taxpayer. you have a gross income of $61,026 and claim two exemptions. you can make a deduction of $2,871 for interest on your mortgage, a deduction of $2,376 for property tax, an adjustment of $3,206 for business losses, an adjustment of $2,575 for contributions to your retirement plan, a deduction of $2,682 for medical expenses, and an adjustment of $2,440 for business expenses. if exemptions are each worth $3,650 and the standard deduction is $5,700, what is your total taxable income?

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:00, Sanchezj104

Marla bought a book for $12.95, a binder for $3.49, and a backpack for $44.99. the sales tax rate is 6%. find the amount of tax and the total she paid for these items

Answers: 3

Mathematics, 22.06.2019 02:00, AnastasiaJauregui

If p(x) is the total value of the production when there are x workers in a plant, then the average productivity of the workforce at the plant is a(x) = p(x) x . (a) find a'(x). a'(x) = xp'(x) − p(x) x a'(x) = xp'(x) − p(x) x2 a'(x) = p'(x) − p(x) x a'(x) = xp'(x) − p'(x) x2 a'(x) = p'(x) − xp(x) x2 why does the company want to hire more workers if a'(x) > 0? a'(x) > 0 ⇒ a(x) is ; that is, the average productivity as the size of the workforce increases. (b) if p'(x) is greater than the average productivity, which of the following must be true? p'(x) − xp(x) > 0 p'(x) − xp(x) < 0 xp'(x) − p'(x) > 0 xp'(x) − p(x) < 0 xp'(x) − p(x) > 0

Answers: 2

Do you know the correct answer?

Say you are filing as a single taxpayer. you have a gross income of $61,026 and claim two exemptions...

Questions in other subjects:

Physics, 13.01.2021 01:00

Mathematics, 13.01.2021 01:00

Mathematics, 13.01.2021 01:00

Mathematics, 13.01.2021 01:00

Spanish, 13.01.2021 01:00

Social Studies, 13.01.2021 01:00