Mathematics, 08.04.2021 20:40, meaghan18

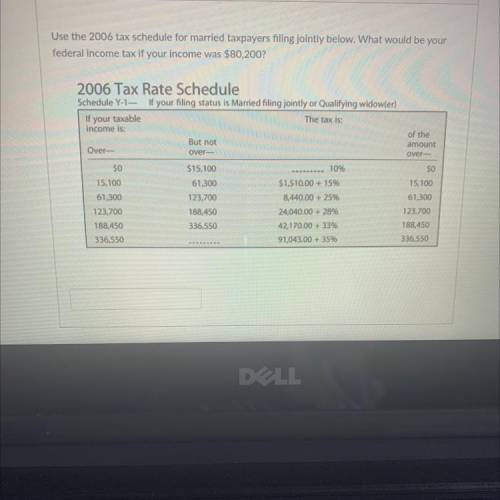

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal income tax if your income was $80,200?

2006 Tax Rate Schedule

Schedule Y-1- If your filing status is Married filing jointly or Qualifying widow(er)

If your taxable

The tax is:

income is:

But not

Over-

over-

of the

amount

over-

10%

$1,510.00 + 15%

$0

15,100

61,300

123,700

188,450

336,550

$15,100

61,300

123,700

188,450

336,550

8,440.00 + 25%

24,040.00 + 28%

42,170.00 + 33%

91,043.00 + 3596

$0

15,100

61,300

123,700

188,450

336,550

M

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 19:00, 4presidents

The distributive property allows you to say that 3(x − 1) = 3x −

Answers: 1

Do you know the correct answer?

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal in...

Questions in other subjects:

History, 10.09.2019 21:30

Mathematics, 10.09.2019 21:30

Biology, 10.09.2019 21:30

Mathematics, 10.09.2019 21:30

History, 10.09.2019 21:30