Mathematics, 18.03.2021 01:30, alecnewman2002

Victor's gross pay for his pay period was $2,600. He had net pay of $1,556.10. The

Federal Insurance Contributions Act (FICA) taxes amounted to $1.98.90, and federal

taxes were $390. State and local taxes totaled $156) How much did Victor have in

voluntary deductions?

Answers: 1

Other questions on the subject: Mathematics

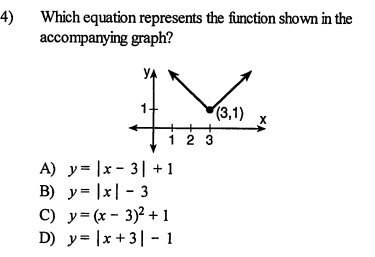

Mathematics, 21.06.2019 13:20, areanna02

Which equation and solution can be used to solve this problem? thirteen less than a number is sixteen. 13-n=16: add 13 to both sides. the answer is 29. n+13=16: subtract 13 from both sides. the answer is 3. n+16=13 subtract 13 from both sides. the answer is 3. n-13=16: add 13 to both sides. the answer is 29.

Answers: 1

Mathematics, 21.06.2019 15:40, aaliyahmaile13

Yo y do yall have 2 stars that means yall wrong bro

Answers: 1

Mathematics, 21.06.2019 16:00, tomtom6870

Trish receives $450 on the first of each month. josh receives $450 on the last day of each month. both trish and josh will receive payments for next four years. at a discount rate of 9.5 percent, what is the difference in the present value of these two sets of payments?

Answers: 1

Mathematics, 21.06.2019 19:20, Courtneymorris19

Which of the following is the result of expanding the series

Answers: 1

Do you know the correct answer?

Victor's gross pay for his pay period was $2,600. He had net pay of $1,556.10. The

Federal Insuranc...

Questions in other subjects: