Mathematics, 09.03.2021 07:20, kdfawesome5582

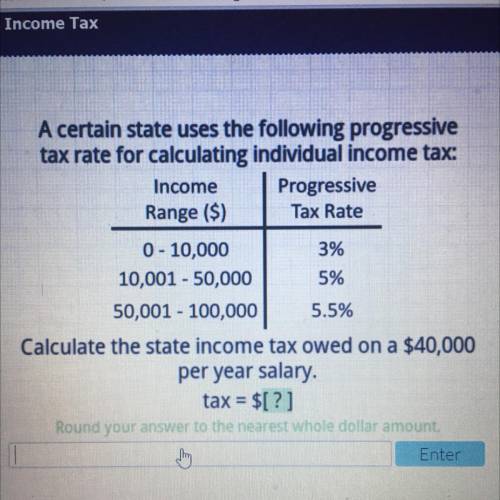

Please help! It would be much appreciated. A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($)

Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:50, kassandramarie16

Amanda went into the grocery business starting with five stores. after one year, she opened two more stores. after two years, she opened two more stores than the previous year. if amanda expands her grocery business following the same pattern, which of the following graphs represents the number of stores she will own over time?

Answers: 3

Mathematics, 21.06.2019 22:30, BigGirlsTheBest

At the beginning of year 1, carlos invests $600 at an annual compound interest rate of 4%. he makes no deposits to or withdrawals from the account. which explicit formula can be used to find the account's balance at the beginning of year 5? what is, the balance?

Answers: 1

Mathematics, 21.06.2019 23:00, nails4life324

Which of the following scenarios demonstrates an exponential decay

Answers: 1

Do you know the correct answer?

Please help! It would be much appreciated. A certain state uses the following progressive

tax rate...

Questions in other subjects:

Health, 25.01.2021 16:30

History, 25.01.2021 16:30

History, 25.01.2021 16:30

Mathematics, 25.01.2021 16:30

Mathematics, 25.01.2021 16:30

English, 25.01.2021 16:30

Computers and Technology, 25.01.2021 16:30