Mathematics, 18.02.2021 20:10, leo4687

A certain state uses the following progressive tax rate for calculating individual income tax: Income Progressive Range ($) Tax Rate 0 - 10,000 3% 10,001 - 50,000 5% 50,001 - 100,000 5.5% Calculate the state income tax owed on a $70,000 per year salary. tax = $[?] Round your answer to the nearest whole dollar amount. Enter

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:00, nathanb29oue8gj

Aheated piece of metal cools according to the function c(x) = (.5)x ? 7, where x is measured in hours. a device is added that aids in cooling according to the function h(x) = ? x ? 2. what will be the temperature of the metal after two hours?

Answers: 2

Mathematics, 21.06.2019 20:30, meowmeowcow

Given: klmn is a parallelogram m? n=3m? k, lf ? kn , ld ? nm kf=2 cm, fn=4 cm find: lf, ld

Answers: 1

Mathematics, 22.06.2019 00:50, yasminothman02

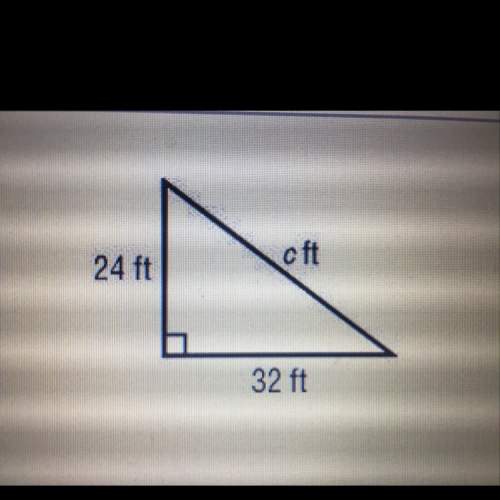

Asource of laser light sends rays ab and ac toward two opposite walls of a hall. the light rays strike the walls at points b and c, as shown below: what is the distance between the walls?

Answers: 2

Do you know the correct answer?

A certain state uses the following progressive tax rate for calculating individual income tax: Incom...

Questions in other subjects:

Mathematics, 02.01.2021 01:10

Mathematics, 02.01.2021 01:10

Health, 02.01.2021 01:10

Mathematics, 02.01.2021 01:10

Mathematics, 02.01.2021 01:10