Mathematics, 14.02.2021 20:40, megaboy

Than Nguyen opened a business called Nguyen engineering and recorded the following transactions in its first month of operations.

June 1: Than Nguyen, the owner, invested $158,000 cash, office equipment with a value of $19,500, and $89,000 of drafting equipment to launch the company in exchange for common stock.

June 2: the company purchased land worth $63,500 for an office by paying $26,000 cash and signing a long-term note payable for $36,900.

June 2: The company purchased a portable building with $40,500 cash and moved it onto the land acquired on June 2.

June 2: The company paid $11,700 cash for the premium on a 15-month insurance policy.

June 7: The company completed and delivered a set of plans for a client and collected $17,800 cash.

June 12: The company purchased $37,400 of additional drafting equipment by paying $24,000 cash and signing a long-term note payable for $13,400.

June 14: The company completed $37,200 of engineering services for a client. This amount is to be received in 30 days.

June 15: The company purchased $2,600 of additional office equipment on credit.

June 17: The company completed engineering services for $27,000 on credit.

June 18: The company revived a bill for rent of equipment that was used on a recently completed job. The $2,750 rent cost must be paid within 30 days.

June 20: The company collected $18,600 cash in partial payment from the client billed on June 14.

June 21: The company paid $2,000 cash for wages to a drafting assistant.

June 23: The company paid $2,600 cash to settle the account payable created on June 15.

June 24: The company paid $1,650 for minor maintenance of its drafting equipment.

June 26: The company paid $10,060 cash in dividends.

June 28: The company paid $2,000 cash for wages to a drafting assistant.

June 30: The company paid $3,660 cash for advertisements on the web during June.

Description of items that require adjusting entries on June 30, follow:

A.) The company has completed, but not yet billed, $17,600 of engineering services for a client.

B.) straight-line depreciation on the office equipment, assuming a 5 year life and a $2,300 salvage value, is $330 per month.

C.) straight-line depreciation on the drafting equipment, assuming a 5 year life and a $12,400 salvage value, is $1,900 per month.

D.) straight-line depreciation on the building, assuming a 25 year life and a $1,500 salvage value, is $130 per month.

E.) the balance in prepaid insurance represents a 15 month policy that went into effect on June 1.

F.) Accrued interest on the long-term note payable is $190.

G.) the drafting assistant is paid $2,000 for a 5 day work week. 2 days’ wages have been incurred but are unpaid as of month end.

Please answer and thank you

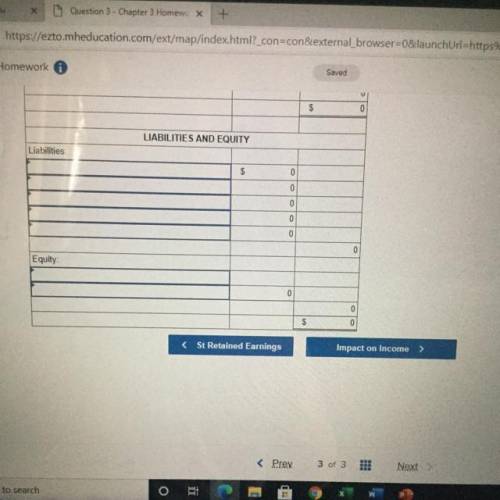

This is the second part of the balance sheet.

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:30, waldruphope3956

Can someone check if i did this right since i really want to make sure it’s correct. if you do you so much

Answers: 2

Mathematics, 21.06.2019 19:00, karellopez96

List the sides of δrst in ascending order (shortest to longest) if: m∠r =x+28°, m∠s = 2x+16°, and m∠t = x+12

Answers: 1

Mathematics, 21.06.2019 21:00, alexkrol10

Describe how making an ‘and’ compound sentence effects your solution set

Answers: 1

Do you know the correct answer?

Than Nguyen opened a business called Nguyen engineering and recorded the following transactions in i...

Questions in other subjects:

Engineering, 17.09.2021 04:10

Business, 17.09.2021 04:10

Chemistry, 17.09.2021 04:10

Biology, 17.09.2021 04:10

History, 17.09.2021 04:20