Mathematics, 08.02.2021 21:40, SCHOOLWORKZ3768

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table provided to compute Drew's tax due and effective

tax rate.

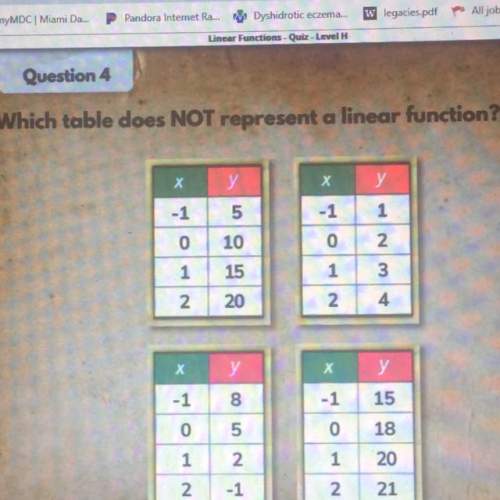

Single Taxpayers: Income Brackets

Tax

Income

Tax Owed

Rate Bracket

10% O to 9,525 10% of taxable income

9,526 to $952.50 plus 12% of

12%

38,700 the excess over $9,525

38,701 to

14,453.50 plus 22% of

2296

the excess over

82,500

$38,700

82,501 to

$14,089.50 plus 24% of

24%

the excess over

157,500

$82,500

157,501 to

$32,089.50 plus 32% of

32%

200,000

the excess over

$157,500

200,001 to

$45,689.50 plus 35% of

35%

the excess over

500,000

$200,000

$150,689.50 plus 37%

37% > 500,000 of the excess over

$500,000

Drew's tax due is

and his effective tax rate is

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:30, zovav1oszg9z

Analyze the graph of the cube root function shown on the right to determine the transformations of the parent function. then, determine the values of a, h, and k in the general equation.

Answers: 1

Mathematics, 21.06.2019 20:30, AdanNava699

If you are dealt 4 cards from a shuffled deck of 52? cards, find the probability that all 4 cards are diamondsdiamonds.

Answers: 1

Do you know the correct answer?

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table p...

Questions in other subjects:

Mathematics, 06.05.2020 06:39

Mathematics, 06.05.2020 06:39

Chemistry, 06.05.2020 06:39

History, 06.05.2020 06:39

English, 06.05.2020 06:39