Mathematics, 18.01.2021 01:10, kenzie3497

You are a high school senior with a part-time job at a retail store. Your employer pays you $9.75 per hour. Last week, you worked a total of 30 hours.

The following payroll deductions were taken from your gross pay:

Federal income tax (withholding) at 10%

Social Security tax at 6.2%

Medicare tax at 1.45%

Use the check stub below to help you think through the problem.

You are encouraged to use scratch paper or Chrome Canvas as a scratch pad. You are allowed to check your calculations with a calculator.

check stub

The amount for MEDICARE TAX for this pay period was $

Blank.

Answers: 2

Other questions on the subject: Mathematics

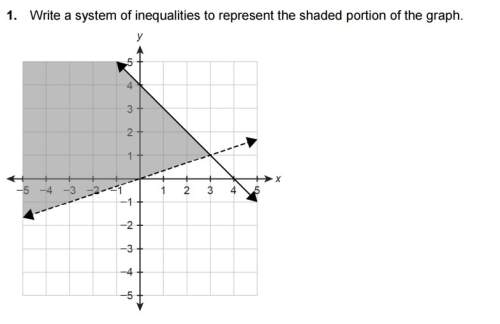

Mathematics, 21.06.2019 15:00, nyraimccall408

Mustafa contributes 11% of his $67,200 annual salary to his 401k plan. what is his pretax income

Answers: 1

Mathematics, 21.06.2019 19:00, ALEXMASTERS64

Moira has a canvas that is 8 inches by 10 inches. she wants to paint a line diagonally from the top left corner to the bottom right corner. approximately how long will the diagonal line be?

Answers: 1

Mathematics, 22.06.2019 00:10, abelSeattle

Juanita wade's new car has an msrp of $28,902.11 including title and processing fees. the premier package which includes surround sound and dvd player costs three times the amount of the in-style package which includes leather seats and select wheels. the total cost of her new car was $34,290.08 which included the 6.5% sales tax. find the cost of the premier package to the nearest cent.

Answers: 3

Do you know the correct answer?

You are a high school senior with a part-time job at a retail store. Your employer pays you $9.75 pe...

Questions in other subjects:

History, 28.06.2021 03:10

Mathematics, 28.06.2021 03:10

Mathematics, 28.06.2021 03:10

SAT, 28.06.2021 03:10