Mathematics, 18.11.2020 14:00, babas97

Firm A, which is considering a vertical merger with another firm, Firm T, currently has a required return of 13 percent. The required return of the target firm, Firm T, is 18 percent. The expected return on the market is 12 percent and the risk-free rate is 6 percent. Assume the market is in equilibrium. If the combined firm will be one and one-half times as large as the acquiring firm using book values what will be the beta of the new merged firm?

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 22:30, mackenziepaige6525

The median for the given set of six ordered data values is 29.5 9 12 25 __ 41 48 what is the missing value?

Answers: 1

Mathematics, 22.06.2019 06:00, lexiremmickp6mlxe

If twice a number is at least three less than four times the number, which of the following are true? let n represent the number.

Answers: 1

Do you know the correct answer?

Firm A, which is considering a vertical merger with another firm, Firm T, currently has a required r...

Questions in other subjects:

History, 17.10.2020 09:01

Mathematics, 17.10.2020 09:01

Mathematics, 17.10.2020 09:01

History, 17.10.2020 09:01

Physics, 17.10.2020 09:01

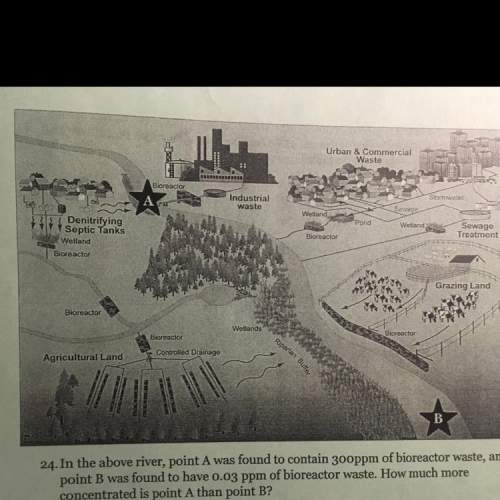

English, 17.10.2020 09:01