Mathematics, 02.11.2020 17:00, applesass

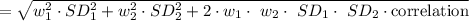

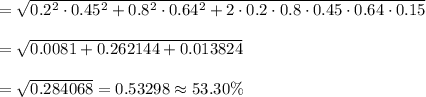

Security F has an expected return of 12.0 percent and a standard deviation of 45.0 percent per year. Security G has an expected return of 17.0 percent and a standard deviation of 64.0 percent per year. a. What is the expected return on a portfolio composed of 20 percent of Security F and 80 percent of Security G? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. If the correlation between the returns of Security F and Security G is .15, what is the standard deviation of the portfolio described in part (a)? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:04, darrenmcfadden220

Super ultra mega important if you can answer this correctly i will give you 100 points but if you don't answer it correctly you'll get a big report. so stay aware and have a nice day!

Answers: 1

Mathematics, 21.06.2019 16:50, catdog5225

The table represents a linear function. what is the slope of the function? –6 –4 4 6

Answers: 3

Mathematics, 21.06.2019 21:00, gavinarcheroz2jxq

Ireally need subtract and simplify.(-y^2 – 4y - 8) – (-4y^2 – 6y + 3)show your work, ! i will mark you brainliest but you have to show your work.

Answers: 1

Mathematics, 21.06.2019 23:00, sandyrose3012

Multiplying fractions by whole number 5 x 1/3=?

Answers: 2

Do you know the correct answer?

Security F has an expected return of 12.0 percent and a standard deviation of 45.0 percent per year....

Questions in other subjects:

History, 29.08.2019 11:30

Mathematics, 29.08.2019 11:30

Social Studies, 29.08.2019 11:30

History, 29.08.2019 11:30

Computers and Technology, 29.08.2019 11:30

History, 29.08.2019 11:30