Mathematics, 21.10.2020 20:01, Ashley606hernandez

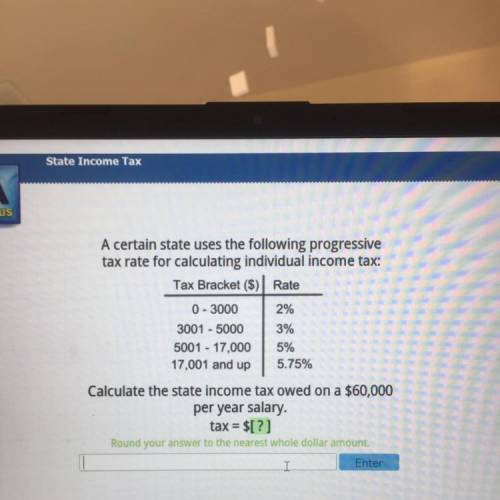

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

0 - 3000 2%

3001 - 5000 3%

5001 - 17,000 5%

17,001 and up 5.75%

Calculate the state income tax owed on a $60,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Entor

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:04, sabrinachambers444

2x+3y=12 x-y=6 solve the following system equations

Answers: 1

Mathematics, 21.06.2019 17:00, ruslffdr

Arestaurant offers a $12 dinner special that has 5 choices for an appetizer, 12 choices for an entrée, and 4 choices for a dessert. how many different meals are available when you select an appetizer, an entrée, and a dessert? a meal can be chosen in nothing ways. (type a whole number.)

Answers: 1

Do you know the correct answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions in other subjects:

Mathematics, 20.09.2020 17:01

History, 20.09.2020 17:01

Physics, 20.09.2020 17:01