Mathematics, 21.10.2020 14:01, Homepage10

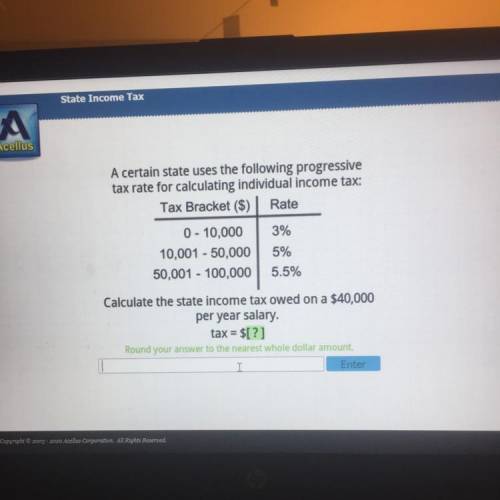

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

3%

0 - 10,000

10,001 - 50,000

50,001 - 100,000

5%

5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $1?1

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:04, alexandra2442

Itook a better photo of the question so y’all can see it i hope it’s a fine photo

Answers: 1

Mathematics, 21.06.2019 19:00, alaina3792

Lucy is a dress maker. she sews \dfrac47 7 4 of a dress in \dfrac34 4 3 hour. lucy sews at a constant rate. at this rate, how many dresses does lucy sew in one hour? include fractions of dresses if applicable

Answers: 3

Mathematics, 22.06.2019 00:30, sadcase85

Astrid spent $36 on new shoes. this was $12 less than twice what she spent on a new skirt. part a: which equation would solve for how much she spent on the skirt? part b: solve the equation in the workspace provided below. how much did astrid spend on her skirt?

Answers: 1

Do you know the correct answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions in other subjects:

English, 13.01.2021 01:50

Mathematics, 13.01.2021 01:50

History, 13.01.2021 01:50

Spanish, 13.01.2021 01:50