Mathematics, 24.06.2020 16:01, tyler6933

Airborne Airlines Inc. has a $1,000 par value bond outstanding with 20 years to maturity. The bond carries an annual interest payment of $102 and is currently selling for $880. Airborne is in a 30 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar.

a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:10, kingbob101

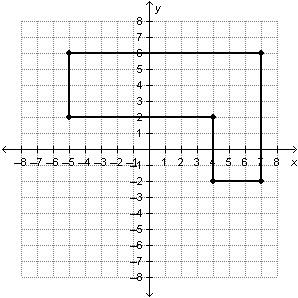

Drag the tiles to the boxes to form correct pairs. not all tiles will be used. match each set of vertices with the type of quadrilateral they form.

Answers: 1

Mathematics, 22.06.2019 03:00, Angellopezzz

Determine whether the question is a statistical question. explain. 1. what is the eye of sixth grade students? 2. at what temperature (in degree fahrenheit) does water freeze? 3. how many pages are in the favorite books of students your age? 4. how many hours do sixth grade students use the internet each week? you!

Answers: 3

Mathematics, 22.06.2019 03:30, davidsouth444

Calculate the mean value (expected value) of the following discrete variable x (10 points): x = 0, 1, 2, 3, 4, 5, 6 p(x) = 0.2, 0.2, 0.15, 0.15, 0.15, 0.1, 0.05

Answers: 1

Do you know the correct answer?

Airborne Airlines Inc. has a $1,000 par value bond outstanding with 20 years to maturity. The bond c...

Questions in other subjects: