Mathematics, 06.05.2020 06:10, mikeysoulemison

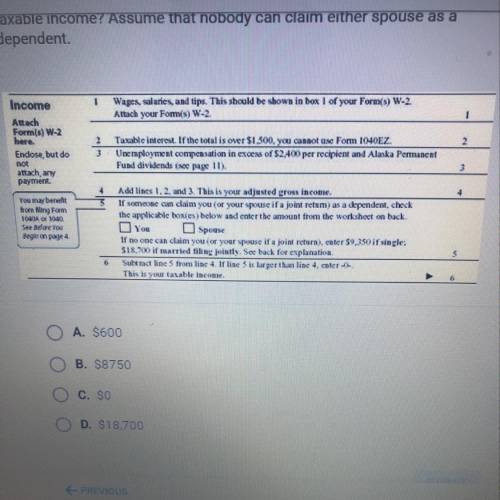

According to the Income section shown below from the 1040EZ form, if a married couple filing their federal income tax return jointly enters \$18,1 on line 4 for adjusted gross income, what would they enter on line 6 for their taxable income? Assume that nobody can claim either spouse as a dependent

A. 600

B. 8750

C. 0

D. 18,700

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:00, shayshayyy41

For what type of equity loan are you lent a lump sum, which is to be paid within a certain period of time? a. a line of credit b. equity c. a second mortgage d. an amortization

Answers: 3

Mathematics, 21.06.2019 23:00, maiacheerz

12 out of 30 people chose their favourite colour as blue caculate the angle you would use for blue on a pie chart

Answers: 1

Mathematics, 21.06.2019 23:30, joelpimentel

Which choice has the correct steps in graphing the solution set to the following inequality? -45_> 20x-5y

Answers: 1

Do you know the correct answer?

According to the Income section shown below from the 1040EZ form, if a married couple filing their f...

Questions in other subjects:

Mathematics, 06.05.2021 17:10

Chemistry, 06.05.2021 17:10

Mathematics, 06.05.2021 17:10

Social Studies, 06.05.2021 17:10

Mathematics, 06.05.2021 17:10

Law, 06.05.2021 17:10

Mathematics, 06.05.2021 17:10

English, 06.05.2021 17:10

Mathematics, 06.05.2021 17:10