Mathematics, 21.03.2020 09:59, keilyn80

"the Capital Asset Pricing Model is a financial model that assumes returns on a portfolio are normally distributed. Suppose a portfolio has an average annual return of 14.7% (i. e. an average gain of 14.7%) with a standard deviation of 33%. A return of 0% means the value of the portfolio doesn't change, a negative return means that the portfolio loses money, and a positive return means that the portfolio gains money.

a.) What percent of years does this portfolio lose money, i. e. have a return less than 0%

b.) What is the cutoff for the highest 15% of annual returns with this portfolio"

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:30, nataliahenderso

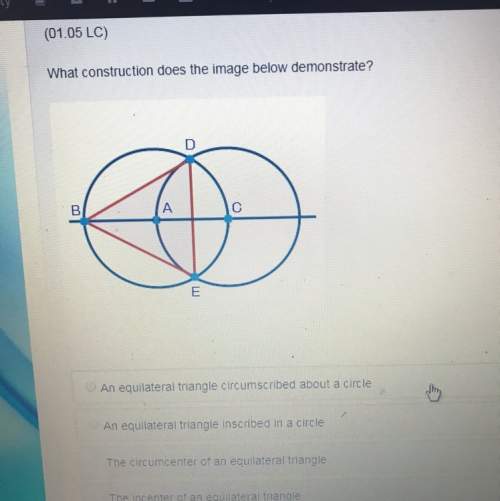

Which interval for the graphed function contains the local maximum? [–3, –2] [–2, 0] [0, 2] [2, 4]

Answers: 2

Mathematics, 21.06.2019 14:40, olivialaine31

Which graph represents the following piecewise defined function?

Answers: 2

Mathematics, 21.06.2019 16:40, joannachavez12345

What is the average rate of change for this function for the interval from x=2 to x=4 ?

Answers: 2

Do you know the correct answer?

"the Capital Asset Pricing Model is a financial model that assumes returns on a portfolio are normal...

Questions in other subjects:

Mathematics, 16.12.2021 23:40

Mathematics, 16.12.2021 23:40

Mathematics, 16.12.2021 23:40

History, 16.12.2021 23:40

and standard deviation

and standard deviation  , the zscore of a measure X is given by:

, the zscore of a measure X is given by: