Mathematics, 28.11.2019 21:31, graycelynn123

Hazel morrison, a mutual fund manager, has a $40 million portfolio with a beta of 1.00. the risk-free rate is 4.25%, and the market risk premium is 6.00%. hazel expects to receive an additional $60 million, which she plans to invest in additional stocks. after investing the additional funds, she wants the fund's required and expected return to be 12.00%.what must the average beta of the new stocks be to achieve the target required rate of return? a. 1.49b. 1.76c. 1.85d. 1.94e. 2.04

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 15:00, TheOneandOnly003

Naomi’s parents want to have 50,000, saved for her college education, if they invest 20000 today and earn 7% interest compound annually, about how long will it take them to save 50 thousand

Answers: 3

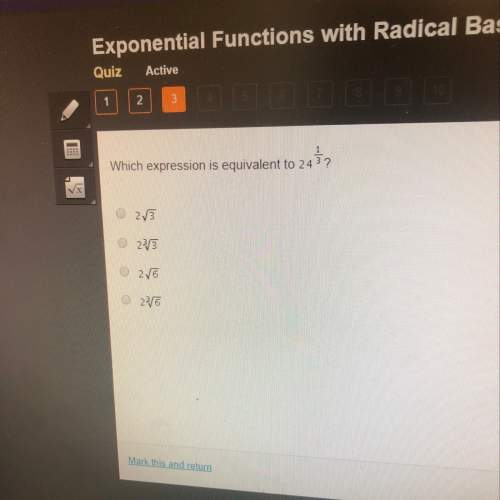

Mathematics, 22.06.2019 04:00, warrior4516

What is the answer to this problem? ignore the work. what is the correct answer?

Answers: 1

Do you know the correct answer?

Hazel morrison, a mutual fund manager, has a $40 million portfolio with a beta of 1.00. the risk-fre...

Questions in other subjects:

Health, 18.12.2020 01:10

History, 18.12.2020 01:10

History, 18.12.2020 01:10

Mathematics, 18.12.2020 01:10

History, 18.12.2020 01:10