Mathematics, 04.11.2019 07:31, carsengilbert

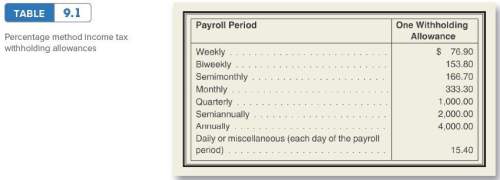

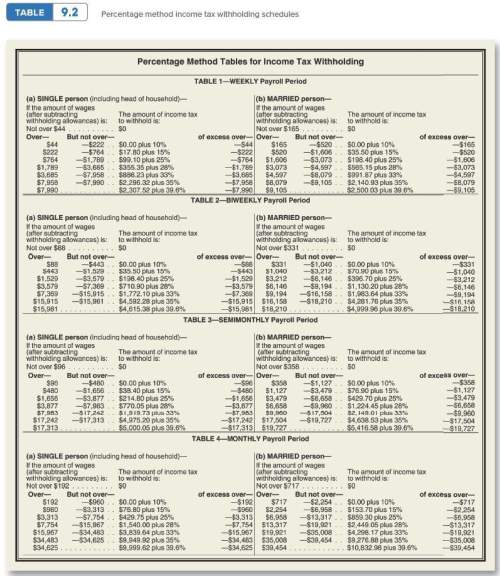

Assume a tax rate of 6.2% on $118,500 for social security and 1.45% for medicare. no one will reach the maximum for fica. complete the following payroll register. (use the percentage method to calculate fit for this weekly period.) (use table 9.1 and table 9.2). (do not round intermediate calculations and round your final answers to the nearest cent.)

employee; pat brown

allowances claimed: 4

gross pay: $4000

find:

fit

s. s.

medicare

net pay

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:30, jwagner1580

Complex numbers multiply √-4 * √-25 and show all intermediate steps. alternative notation is sqrt(-4) * sqrt(-25).

Answers: 1

Mathematics, 21.06.2019 19:30, jessnolonger

Zoey made 5 1/2 cups of trail mix for a camping trip. she wants to divide the trail mix into 3/4 cup servings. a. ten people are going on the trip. can zoey make enough 3/4 cup servings so that each person gets one serving? b. what size would the servings need to be for everyone to have a serving?

Answers: 1

Do you know the correct answer?

Assume a tax rate of 6.2% on $118,500 for social security and 1.45% for medicare. no one will reach...

Questions in other subjects:

Biology, 03.07.2019 01:00

Mathematics, 03.07.2019 01:00

Biology, 03.07.2019 01:00

Biology, 03.07.2019 01:00