Mathematics, 22.10.2019 23:30, monsterwins5001

Veronica is self employed. in one year, veronica generates a gross income of $65,500. when calculating her taxes, veronica is allowed to deduct up to $2,500 in expenses from her gross income (to give the 'operating income'), but if her expenses exceed $2,500 then any surplus must be deducted against her income after tax. in this calendar year, veronica's total expenses were $5,500. the tax system is such that she must pay 15% tax on any operating income up to $25,000 and then 30% on any operating income over $25,000. calculate veronica's net profit, that is, the amount she earns after all taxes and expenses.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:20, psychocatgirl1

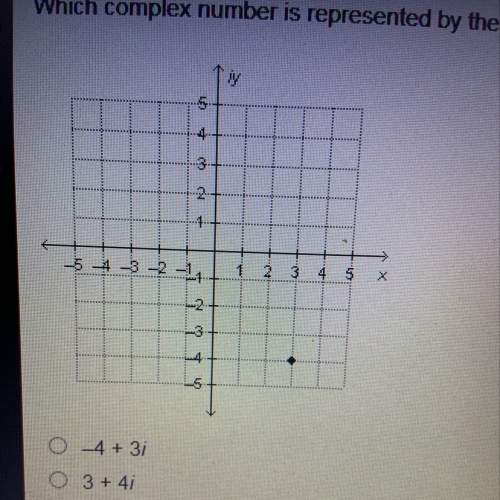

Which system of linear inequalities is represented by the graph? + l tv x-3y > 6 and y > 2x o x + 3y > 6 and y o x-3y > 6 and y> 2x o x + 3y > 6 and y > 2x + 4 la +

Answers: 1

Mathematics, 21.06.2019 18:30, avahrhey24

Sketch one cycle if the cosine function y=2cos2theta

Answers: 1

Do you know the correct answer?

Veronica is self employed. in one year, veronica generates a gross income of $65,500. when calculati...

Questions in other subjects:

Social Studies, 27.04.2021 21:00

Mathematics, 27.04.2021 21:00

History, 27.04.2021 21:00