Business, 28.07.2019 11:00, aubreerosehennessy95

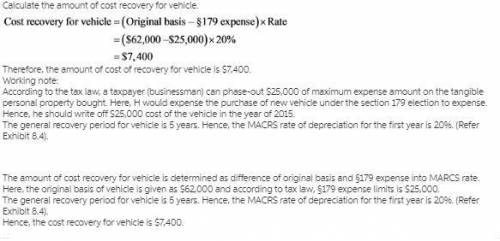

On march 15, 2017, helen purchased and placed in service a new escalade. the purchase price was $62,000, and the vehicle had a rating of 6,500 gvw. the vehicle was used 100% for business. helen does claim any available additional first-year depreciation. if required, round your answers to the nearest dollar.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 23:00, ehthaboe7265

Consider a consumer who is contemplating a new automobile purchase. she has narrowed her decision down to two brands, honda accord and ford taurus. she has identified gas mileage, price, warranty, and styling to be important attributes to consider in her decision

Answers: 1

Business, 23.06.2019 04:40, betoo9090

Aneighborhood home owners association suspects that the recent appraisal values of the houses in the neighborhood conducted by the county government for taxation purposes is too high. it hired a private company to appraise the values of ten houses in the neighborhood. the results, in thousands of dollars, are?

Answers: 1

Business, 23.06.2019 06:30, janeou17xn

Afinance company wants to upgrade its accounting software to a higher version. this version change requires a change in data formats. which method represents a change in data formats?

Answers: 1

Do you know the correct answer?

On march 15, 2017, helen purchased and placed in service a new escalade. the purchase price was $62,...

Questions in other subjects:

Biology, 22.01.2020 03:31

Mathematics, 22.01.2020 03:31

Social Studies, 22.01.2020 03:31

Social Studies, 22.01.2020 03:31

Biology, 22.01.2020 03:31