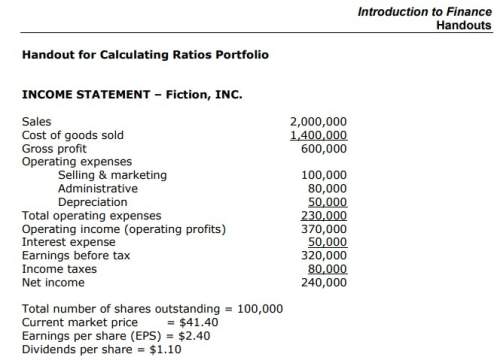

Calculating ratios portfolio

use a spreadsheet software program (like microsoft excel) to calc...

Business, 23.12.2019 11:31, cecelia090

Calculating ratios portfolio

use a spreadsheet software program (like microsoft excel) to calculate and report the following information:

-what is the current ratio of this firm

-what is the quick ratio of this firm

-what is the inventory turnover ratio of this firm

-what is the receivables turnover of this firm

-what is the total asset turnover of this firm

-what is the times interest earned (tie) of this firm

-what is the total debt ratio of this firm

-what is the return on equity (roe) of this firm

-what is the return of assets (roa) of this firm

-what is the market-to-book ratio of this firm

-what is the price-to-earnings (p/e) ratio of this firm

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 09:00, episodegirl903

You speak to a business owner that is taking in almost $2000 in revenue each month. the owner still says that they are having trouble keeping the doors open. how can that be possible? use the terms of revenue, expenses and profit/loss in your answer

Answers: 3

Business, 22.06.2019 11:30, zitterkoph

Leticia has worked for 20 years in the public relations department of a large firm and has been the vice-president for the past ten years. it is unlikely she will ever be promoted to the top executive position in her firm even though she has directed several successful projects and is quite capable. her lack of promotion is an illustration of (a) the "glass ceiling" (b) the "glass elevator" (c) the "mommy track" (d) sexual harassment

Answers: 3

Business, 22.06.2019 11:30, fjjjjczar8890

Which of the following statements about cash basis accounting is true? a. it is more complicated than accrual basis accounting. b. the irs allows all types of corporations to use it. c. it follows gaap standards. d. it ensures the company always knows how much cash flow it has.

Answers: 2

Business, 22.06.2019 12:50, emarquez05

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Do you know the correct answer?

Questions in other subjects:

Mathematics, 03.02.2020 03:50

Mathematics, 03.02.2020 03:50

Mathematics, 03.02.2020 03:50

Mathematics, 03.02.2020 03:50

English, 03.02.2020 03:50

Biology, 03.02.2020 03:50