Business, 10.03.2022 08:50, raulriquelmef6p0947w

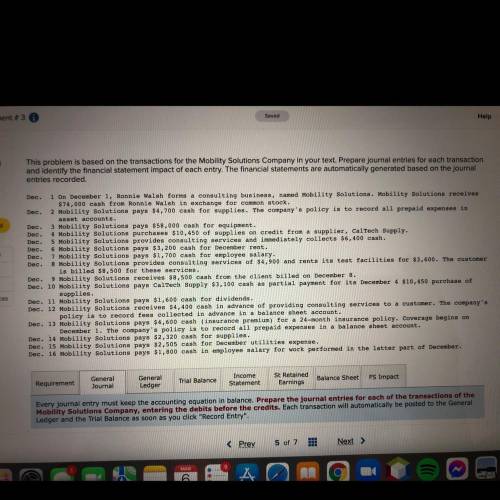

This problem is based on the transactions for the Mobility Solutions Company in your text. Prepare journal entries for each transaction

and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal

entries recorded.

Dec.

Dec. 1 On December 1, Ronnie Walsh forms a consulting business, named Mobility Solutions. Mobility Solutions receives

$74,000 cash from Ronnie Walsh in exchange for common stock.

2 Mobility Solutions pays $4,700 cash for supplies. The company's policy is to record all prepaid expenses in

asset accounts.

Dec. 3 Mobility Solutions pays $58,000 cash for equipment.

Dec. 4 Mobility Solutions purchases $10,450 of supplies on credit from a supplier, CalTech Supply.

Dec. 5 Mobility Solutions provides consulting services and immediately collects $6,400 cash.

Dec. 6 Mobility Solutions pays $3,200 cash for December rent.

Dec. 7 Mobility Solutions pays $1,700 cash for employee salary.

Dec. 8 Mobility Solutions provides consulting services of $4,900 and rents its test facilities for $3,600. The customer

is billed $8,500 for these services.

Dec. 9 Mobility Solutions receives $8,500 cash from the client billed on December 8.

Dec. 10 Mobility Solutions pays CalTech Supply $3,100 cash as partial payment for its December 4 $10,450 purchase of

supplies.

Dec. 11 Mobility Solutions pays $1,600 cash for dividends.

Dec. 12 Mobility Solutions receives $4,400 cash in advance of providing consulting services to a customer. The company's

policy is to record fees collected in advance in a balance sheet account.

Dec. 13 Mobility Solutions pays $4,600 cash (insurance premium) for a 24-month insurance policy. Coverage begins on

December 1. The company's policy is to record all prepaid expenses in a balance sheet account.

Dec. 14 Mobility Solutions pays $2,320 cash for supplies.

Dec. 15 Mobility Solutions pays $2,505 cash for December utilities expense.

Dec. 16 Mobility Solutions pays $1,800 cash in employee salary for work performed in the latter part of December.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 02:00, 544620

Answer the following questions using the information below: southwestern college is planning to hold a fund raising banquet at one of the local country clubs. it has two options for the banquet: option one: crestview country club a. fixed rental cost of $1,000 b. $12 per person for food option two: tallgrass country club a. fixed rental cost of $3,000 b. $8.00 per person for food southwestern college has budgeted $1,800 for administrative and marketing expenses. it plans to hire a band which will cost another $800. tickets are expected to be $30 per person. local business supporters will donate any other items required for the event. which option has the lowest breakeven point?

Answers: 1

Business, 22.06.2019 02:30, kseniyayakimno

Luc do purchased stocks for $6,000. he paid $4,000 in cash and borrowed $2,000 from the brokerage firm. he bought 100 shares at $60.00 per share ($6,000 total). the loan has an annual interest rate of 8 percent. six months later, luc do sold the stock for $65 per share. he paid a commission of $120 and repaid the loan. his net profit was how much? pls

Answers: 3

Business, 22.06.2019 14:50, keishadawson

The following information is needed to reconcile the cash balance for gourmet catering services. * a deposit of $5,600 is in transit. * outstanding checks total $1,000. * the book balance is $6,400 at february 28, 2019. * the bookkeeper recorded a $1,800 check as $17,200 in payment of the current month's rent. * the bank balance at february 28, 2019 was $17,410. * a deposit of $400 was credited by the bank for $4,000. * a customer's check for $3,300 was returned for nonsufficient funds. * the bank service charge is $90. what was the adjusted book balance?

Answers: 1

Business, 23.06.2019 03:20, briyuna15

Suppose the following items were taken from the 2017 financial statements of whispering winds corp.. (all dollars are in millions.) common stock $3,230 accumulated depreciation—equipment $3,940 prepaid rent 175 accounts payable 1,560 equipment 6,940 patents 2,270 stock investments (long-term) 670 notes payable (long-term) 780 debt investments (short-term) 1,740 retained earnings 6,175 income taxes payable 150 accounts receivable 1,740 cash 1,290 inventory 1,010 prepare a classified balance sheet in good form as of december 31, 2017. (list current assets in order of liquidity.)

Answers: 3

Do you know the correct answer?

This problem is based on the transactions for the Mobility Solutions Company in your text. Prepare j...

Questions in other subjects:

Biology, 06.04.2020 22:01

Chemistry, 06.04.2020 22:01

Mathematics, 06.04.2020 22:01

Mathematics, 06.04.2020 22:01

History, 06.04.2020 22:01

Mathematics, 06.04.2020 22:01