Business, 02.03.2022 18:10, bommers144

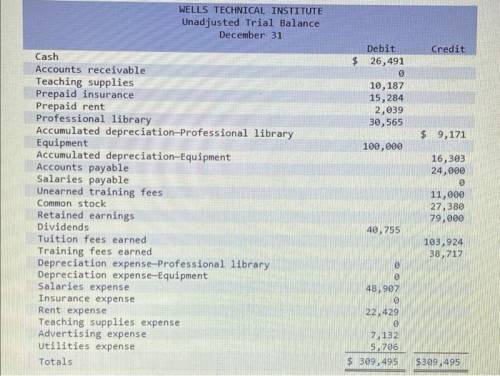

A. An analysis of WTI's insurance policies shows that $2,674 of coverage has expired.

b. An inventory count shows that teaching supplies costing $2,318 are available at year-end.

c. Annual depreciation on the equipment is $10,698.

d. Annual depreciation on the professional library is $5,349.

e. On September 1, WTI agreed to do five courses for a client for $3,000 each. Two courses will start immediately and

finish before the end of the year. Three courses will not begin until next year. The client paid $15,000 cash in advance

for all five courses on September 1, and WTI credited Unearned Revenue.

f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at

the end of the class. At December 31, $5,653 of the tuition revenue has been earned by WTI.

g. WTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per

day for each employee.

h. The balance in the Prepaid Rent account represents rent for December.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 03:20, nakeytrag

The treasurer for pittsburgh iron works wishes to use financial futures to hedge her interest rate exposure. she will sell five treasury futures contracts at $139,000 per contract. it is july and the contracts must be closed out in december of this year. long-term interest rates are currently 7.30 percent. if they increase to 9.50 percent, assume the value of the contracts will go down by 20 percent. also if interest rates do increase by 2.2 percent, assume the firm will have additional interest expense on its business loans and other commitments of $149,000. this expense, of course, will be separate from the futures contracts. a. what will be the profit or loss on the futures contract if interest rates increase to 9.50 percent by december when the contract is closed out

Answers: 1

Business, 22.06.2019 12:40, abilovessoftball

Which of the following tasks would be a line cook's main responsibility? oa. frying french fries ob. chopping onions oc. taking inventory of stocked dry goods od. paying invoices

Answers: 2

Business, 22.06.2019 19:00, chloesmolinski0909

Why is accountability important in managing safety

Answers: 2

Business, 22.06.2019 19:20, cathydaves

Bcorporation, a merchandising company, reported the following results for october: sales $ 490,000 cost of goods sold (all variable) $ 169,700 total variable selling expense $ 24,200 total fixed selling expense $ 21,700 total variable administrative expense $ 13,200 total fixed administrative expense $ 33,600 the contribution margin for october is:

Answers: 1

Do you know the correct answer?

A. An analysis of WTI's insurance policies shows that $2,674 of coverage has expired.

b. An invent...

Questions in other subjects:

Computers and Technology, 17.02.2020 19:15

Mathematics, 17.02.2020 19:15

World Languages, 17.02.2020 19:16