Business, 22.02.2022 17:50, michaellagann2020

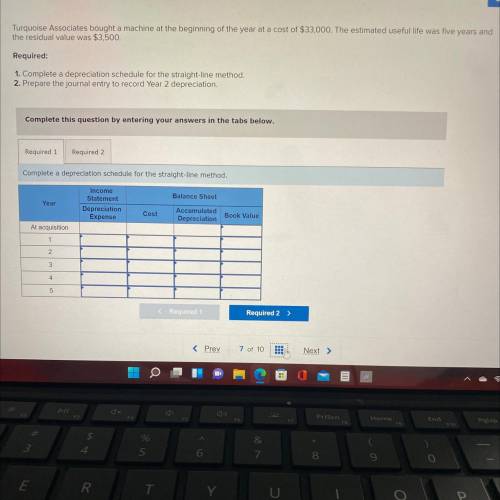

Turquoise Associates bought a machine at the beginning of the year at a cost of $33,000. The estimated useful life was five years and

the residual value was $3,500.

Required:

1. Complete a depreciation schedule for the straight-line method.

2. Prepare the journal entry to record Year 2 depreciation

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete a depreciation schedule for the straight-line method.

Income

Statement

Balance Sheet

Year

Depreciation

Accumulated

Cost

Book Value

Expense

Depreciation

At acquisition

1

2

3

4

5

Required

Required 2)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 03:00, jamesgotqui6

Presented below is a list of possible transactions. analyze the effect of the 18 transactions on the financial statement categories indicated. transactions assets liabilities owners’ equity net income 1. purchased inventory for $80,000 on account (assume perpetual system is used). 2. issued an $80,000 note payable in payment on account (see item 1 above). 3. recorded accrued interest on the note from item 2 above. 4. borrowed $100,000 from the bank by signing a 6-month, $112,000, zero-interest-bearing note. 5. recognized 4 months’ interest expense on the note from item 4 above. 6. recorded cash sales of $75,260, which includes 6% sales tax. 7. recorded wage expense of $35,000. the cash paid was $25,000; the difference was due to various amounts withheld. 8. recorded employer’s payroll taxes. 9. accrued accumulated vacation pay. 10. recorded an asset retirement obligation. 11. recorded bonuses due to employees. 12. recorded a contingent loss on a lawsuit that the company will probably lose. 13. accrued warranty expense (assume expense warranty approach). 14. paid warranty costs that were accrued in item 13 above. 15. recorded sales of product and related service-type warranties. 16. paid warranty costs under contracts from item 15 above. 17. recognized warranty revenue (see item 15 above). 18. recorded estimated liability for premium claims outstanding.

Answers: 1

Business, 22.06.2019 19:30, dominickstrickland

Kirnon clinic uses client-visits as its measure of activity. during july, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. the clinic has provided the following data concerning the formulas to be used in its budgeting: fixed element per month variable element per client-visitrevenue - $ 39.10personnel expenses $ 35,100 $ 10.30medical supplies 1,100 7.10occupancy expenses 8,100 1.10administrative expenses 5,100 0.20total expenses $ 49,400 $ 18.70the activity variance for net operating income in july would be closest to:

Answers: 1

Business, 22.06.2019 20:00, davidaagurto

If a hotel has 100 rooms, and each room takes 25 minutes to clean, how many housekeepers working 8-hour shifts does the hotel need at 50 percent occupancy?

Answers: 1

Business, 22.06.2019 20:30, lareynademividp0a99r

The smelting department of kiner company has the following production and cost data for november. production: beginning work in process 3,700 units that are 100% complete as to materials and 23% complete as to conversion costs; units transferred out 10,500 units; and ending work in process 8,100 units that are 100% complete as to materials and 41% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs for the month of november.

Answers: 3

Do you know the correct answer?

Turquoise Associates bought a machine at the beginning of the year at a cost of $33,000. The estimat...

Questions in other subjects:

Social Studies, 08.10.2020 06:01

Mathematics, 08.10.2020 06:01

Social Studies, 08.10.2020 06:01

English, 08.10.2020 06:01

Mathematics, 08.10.2020 06:01

Mathematics, 08.10.2020 06:01

Mathematics, 08.10.2020 06:01