Business, 24.12.2021 07:40, roseemariehunter12

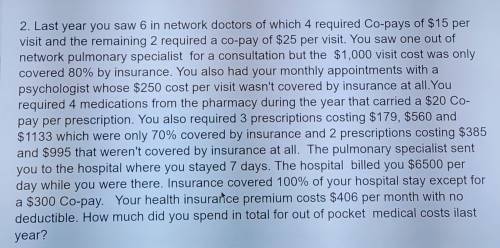

Last year you saw 6 in network doctors of which 4 required Co-pays of $15 per visit and the remaining 2 required a co-pay of $25 per visit. You saw one out of network pulmonary specialist for a consultation but the \$1,( visit cost was only covered 80% by insurance. You also had your monthly appointments with a psychologist whose $250 cost per visit wasn't covered by insurance at all. You required 4 medications from the pharmacy during the year that carried a $20 Co pay per prescription. You also required 3 prescriptions costing $179, $560 and $1133 which were only 70% covered by insurance and 2 prescriptions costing $385 and $995 that weren't covered by insurance at all. The pulmonary specialist sent you to the hospital where you stayed 7 days. The hospital billed you $6500 per day while you were there. Insurance covered 100% of your hospital stay except for a $300 Co-pay. Your health insurance premium costs $406 per month with no deductible. How much did you spend in total for out of pocket medical costs ilast year?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:00, jboii11

Choose the list of the best uses for word processing software. lists, resumes, writing a book, and payroll data letters to your friends, resumes, spreadsheets, and school papers resumes, cover letters, databases, and crossword puzzles book reports, letters to your friends, resumes, and contracts

Answers: 2

Business, 22.06.2019 02:30, maxicanofb0011

Based on the supply and demand theory, why do medical doctors earn higher wages than child-care workers?

Answers: 1

Business, 22.06.2019 20:40, homework1911

Cherokee inc. is a merchandiser that provided the following information: amount number of units sold 20,000 selling price per unit $ 30 variable selling expense per unit $ 4 variable administrative expense per unit $ 2 total fixed selling expense $ 40,000 total fixed administrative expense $ 30,000 beginning merchandise inventory $ 24,000 ending merchandise inventory $ 44,000 merchandise purchases $ 180,000 required: 1. prepare a traditional income statement. 2. prepare a contribution format income statement.

Answers: 2

Business, 22.06.2019 21:00, crazylogic963

China's new 5 percent tax on disposable wooden chopsticks, reflecting concerns about deforestation, has been praised by environmentalists. the move is hitting hard at the japanese, who consume 25 billion set of wooden chopsticks annually. almost all of the chopsticks used in japan come from china. the reuirements for chinese manufacturers of wooden chopsticks to pay the 5 percent tax is a factor in their external environment.

Answers: 3

Do you know the correct answer?

Last year you saw 6 in network doctors of which 4 required Co-pays of $15 per visit and the remainin...

Questions in other subjects:

Business, 28.08.2019 18:30

Mathematics, 28.08.2019 18:30