Help help help help help help

...

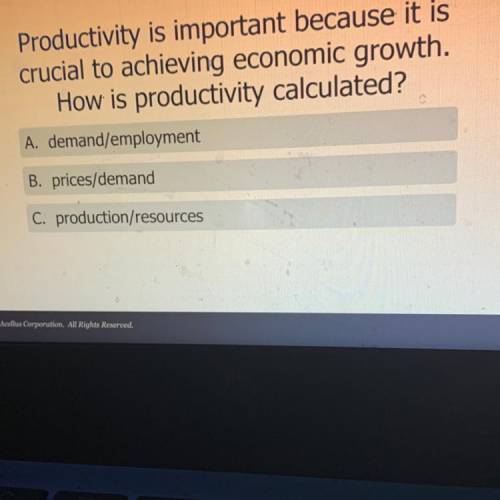

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:00, koolja3

Chance company had two operating divisions, one manufacturing farm equipment and the other office supplies. both divisions are considered separate components as defined by generally accepted accounting principles. the farm equipment component had been unprofitable, and on september 1, 2018, the company adopted a plan to sell the assets of the division. the actual sale was completed on december 15, 2018, at a price of $600,000. the book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. the division incurred a before-tax operating loss from operations of $130,000 from the beginning of the year through december 15. the income tax rate is 40%. chance’s after-tax income from its continuing operations is $350,000. required: prepare an income statement for 2018 beginning with income from continuing operations. include appropriate eps disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 2

Business, 23.06.2019 04:40, CaleWort92

Which is not true of birthday and/or annual review automatics? a. the purpose is to trigger a telephone call for a face-to-face meeting. b. quarterly automatic contacts decrease cross-sales and lead to reduced referrals. c. you are expected to stay in touch with all your active prospects and clients through two personal contacts each year?

Answers: 1

Business, 23.06.2019 13:20, iamasia06

Sam owns speedy bricklayers, inc., a company that specializes in bricklaying. to maintain his business's reputation for quick, quality bricklaying, sam requires that all employees are experienced bricklayers. this discriminates against potential employees who have never laid bricks before. sam is likely:

Answers: 2

Do you know the correct answer?

Questions in other subjects:

English, 26.06.2021 01:00

Mathematics, 26.06.2021 01:00