Please use the following information for Questions 1-2.

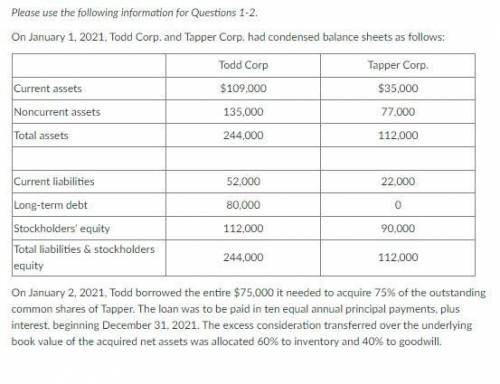

On January 1, 2021, Todd Corp. and Tapper Corp. had condensed balance sheets as follows:

Todd Corp Tapper Corp.

Current assets $109,000 $35,000

Noncurrent assets 135,000 77,000

Total assets 244,000 112,000

Current liabilities 52,000 22,000

Long-term debt 80,000 0

Stockholders' equity 112,000 90,000

Total liabilities & stockholders equity 244,000 112,000

On January 2, 2021, Todd borrowed the entire $75,000 it needed to acquire 75% of the outstanding common shares of Tapper. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2021. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.

Flag question: Question 1

Question 13 pts

What are consolidated current assets at January 2, 2021?

Group of answer choices

$148,000

$141,250

$135,250

$150,000

$144,000

Flag question: Question 2

Question 23 pts

What are consolidated current liabilities at January 2, 2021?

Group of answer choices

$80,000

$69,500

$81,500

$52,000

$74,000

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 00:00, necolewiggins1043

When is going to be why would you put money into saving account

Answers: 1

Business, 22.06.2019 03:30, skylar1315

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

Business, 22.06.2019 04:30, fixianstewart

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Do you know the correct answer?

Please use the following information for Questions 1-2.

On January 1, 2021, Todd Corp. and Tapper...

Questions in other subjects:

Mathematics, 19.08.2019 06:50

Mathematics, 19.08.2019 06:50

Mathematics, 19.08.2019 06:50

Chemistry, 19.08.2019 06:50

Mathematics, 19.08.2019 06:50

Biology, 19.08.2019 06:50