Business, 17.10.2021 17:00, tiwaribianca475

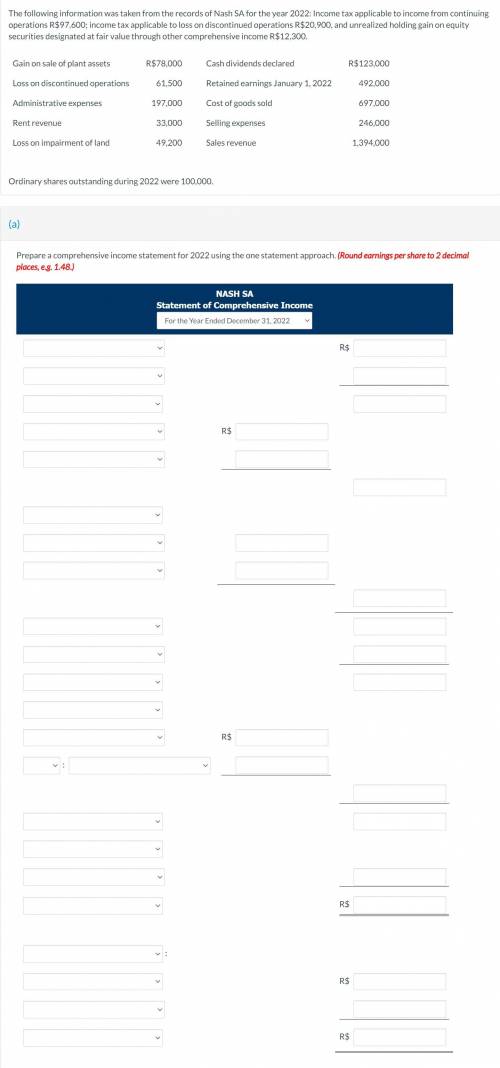

The following information was taken from the records of Nash SA for the year 2022: Income tax applicable to income from continuing operations R$97,600; income tax applicable to loss on discontinued operations R$20,900, and unrealized holding gain on equity securities designated at fair value through other comprehensive income R$12,300.

Gain on sale of plant assets

R$78,000

Cash dividends declared

R$123,000

Loss on discontinued operations

61,500

Retained earnings January 1, 2022

492,000

Administrative expenses

197,000

Cost of goods sold

697,000

Rent revenue

33,000

Selling expenses

246,000

Loss on impairment of land

49,200

Sales revenue

1,394,000

Ordinary shares outstanding during 2022 were 100,000.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 09:40, cerna

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

Business, 22.06.2019 14:30, mathhelppls14

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 19:50, lucky1940

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

Do you know the correct answer?

The following information was taken from the records of Nash SA for the year 2022: Income tax applic...

Questions in other subjects:

History, 19.03.2021 20:40

Mathematics, 19.03.2021 20:40

Chemistry, 19.03.2021 20:40

Mathematics, 19.03.2021 20:40

English, 19.03.2021 20:40