Answer question two please

...

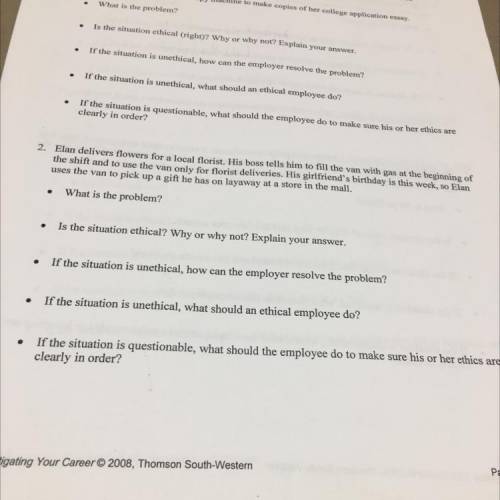

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:30, divadebbgirl1

Ryan terlecki organized a new internet company, capuniverse, inc. the company specializes in baseball-type caps with logos printed on them. ryan, who is never without a cap, believes that his target market is college and high school students. you have been hired to record the transactions occurring in the first two weeks of operations. issued 2,900 shares of $0.01 par value common stock to investors for cash at $29 per share. borrowed $68,000 from the bank to provide additional funding to begin operations; the note is due in two years. paid $1,000 for the current month's rent of a warehouse and another $1,000 for next month's rent. paid $1,440 for a one-year fire insurance policy on the warehouse (recorded as a prepaid expense). purchased furniture and fixtures for the warehouse for $16,000, paying $3,200 cash and the rest on account. the amount is due within 30 days. purchased for $2,800 cash the university of pennsylvania, notre dame, the university of texas at austin, and michigan state university baseball caps as inventory to sell online. placed advertisements on google for a total of $340 cash. sold caps totaling $1,900, half of which was charged on account. the cost of the caps sold was $1,100. (hint: make two entries.) made full payment for the furniture and fixtures purchased on account in (e). received $280 from a customer on account.

Answers: 2

Business, 22.06.2019 05:40, Jenan25

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

Business, 22.06.2019 13:30, Mariaisagon9050

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

Business, 22.06.2019 22:50, rydersasser12

Awork system has five stations that have process times of 5, 9, 4, 9, and 8. what is the throughput time of the system? a. 7b. 4c. 18d. 35e. 9

Answers: 2

Do you know the correct answer?

Questions in other subjects:

Arts, 24.09.2019 12:30

Biology, 24.09.2019 12:30

Mathematics, 24.09.2019 12:30