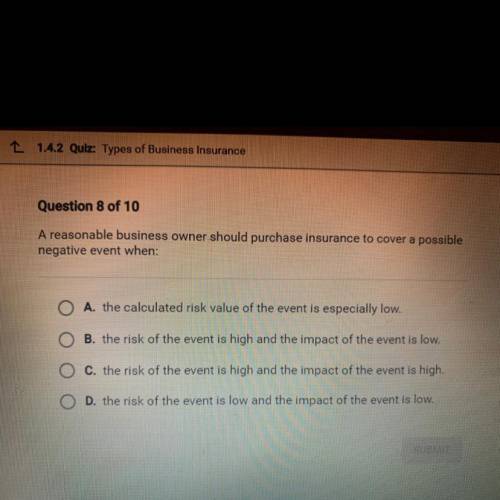

A reasonable business owner should purchase insurance to cover a possible

negative event when:

A. the calculated risk value of the event is especially low.

B. the risk of the event is high and the impact of the event is low.

C. the risk of the event is high and the impact of the event is high.

D. the risk of the event is low and the impact of the event is low.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 15:00, menendezliliana5

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

Do you know the correct answer?

A reasonable business owner should purchase insurance to cover a possible

negative event when:

Questions in other subjects:

Social Studies, 01.11.2021 23:00

Spanish, 01.11.2021 23:00

Biology, 01.11.2021 23:00

Social Studies, 01.11.2021 23:10