Business, 22.07.2021 20:40, ansonhunter8891

Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs:

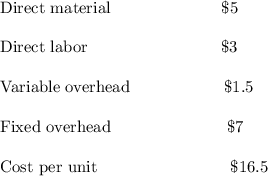

Direct materials $5.00

Direct labor 3.00

Variable overhead 1.50

Fixed overhead 7.00

Variable marketing cost 1.20

Fixed overhead per unit 1.20

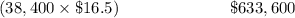

Total fixed factory overhead is $280,000 per month. During October, 38,400 units were sold at a price of $24, and fixed marketing and administrative expenses were $130,500.

Required:

1. Calculate the cost of each unit using absorption costing.

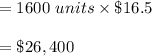

2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing?

3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:30, chycooper101

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 13:10, jameahkitty123

bradford, inc., expects to sell 9,000 ceramic vases for $21 each. direct materials costs are $3, direct manufacturing labor is $12, and manufacturing overhead is $3 per vase. the following inventory levels apply to 2019: beginning inventory ending inventory direct materials 3,000 units 3,000 units work-in-process inventory 0 units 0 units finished goods inventory 300 units 500 units what are the 2019 budgeted production costs for direct materials, direct manufacturing labor, and manufacturing overhead, respectively?

Answers: 2

Business, 22.06.2019 13:30, ayoismeisalex

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 22.06.2019 19:40, pchisholm100

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

Do you know the correct answer?

Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month...

Questions in other subjects:

Mathematics, 17.06.2021 19:00

English, 17.06.2021 19:00

Mathematics, 17.06.2021 19:00

History, 17.06.2021 19:00

Mathematics, 17.06.2021 19:00